- Despite some pushback from global regulators, a Wall Street veteran and CEO of Japanese online broker Monex says the new crypto asset class could take off like derivatives did 38 years ago.

- “Regulators really hated derivatives in 1980 but just soon after that they really embraced them,” says Oki Matsumoto, CEO of Monex Group.

- This week, Monex Group completed its acquisition of cryptocurrency exchange Coincheck, which suffered a $534 million hack in January.

Despite some pushback from global regulators, Wall Street veteran and CEO of Japanese online broker Monex Group says the new crypto asset class could take off like derivatives did 38 years ago.

“Regulators really hated derivatives in 1980 but just soon after that they really embraced them,” Oki Matsumoto, CEO of Monex, said on stage at the Japan Society in New York Tuesday. “What’s happening in the crypto world today is very similar to derivatives in the 1980s, and sooner or later all of those regulatory frameworks will be fixed.”

The Japanese CEO started his career in derivatives at Solomon Brothers in 1987. Matsumoto later spent 12 years at Goldman Sachs, where he launched the investment bank’s yen fixed-income trading desk.

Matsumoto now runs Monex, which he established in 1999 with Sony Corporation. This week, Monex Group completed its acquisition of cryptocurrency exchange Coincheck, which was the target of a $534 million hack in January.

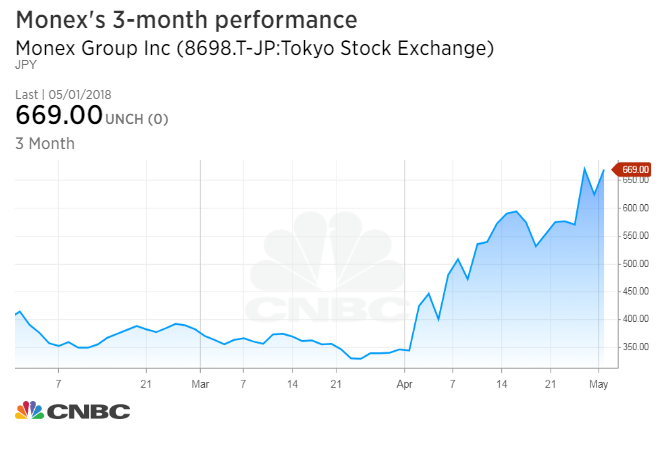

“We work beautifully together, they can provide a lot of value,” the CEO said, adding that shares of Monex have doubled since that deal was announced in April.

Having a regulated public company in Japan buy a crypto exchange was widely seen as a confidence boost for the space.

Similar to cryptocurrency, Matsumoto said the concept of derivatives was confusing in the early days.

“Only a few people could understand derivatives, just the rocket scientists and those people,” Matsumoto said. “But five years later, all the biggest schools in the world were teaching derivatives.”

High tax rates on cryptocurrency, which can be as high as 55 percent in Japan, have been a roadblock for retail investors, he said. Traders however, aren’t as worried.

“You don’t drink thinking about getting hungover the next day,” Matsumoto said. “I think it’s going to take time for Japanese retail people to move a good portion of money into crypto.”

Cryptocurrency volatility has captured the attention of traders looking to profit, especially after bitcoin rose more than 1,300, to near $20,000 last year. The cryptocurrency was trading near $9,000 Tuesday, according to CoinDesk.

Read more at: CNBC