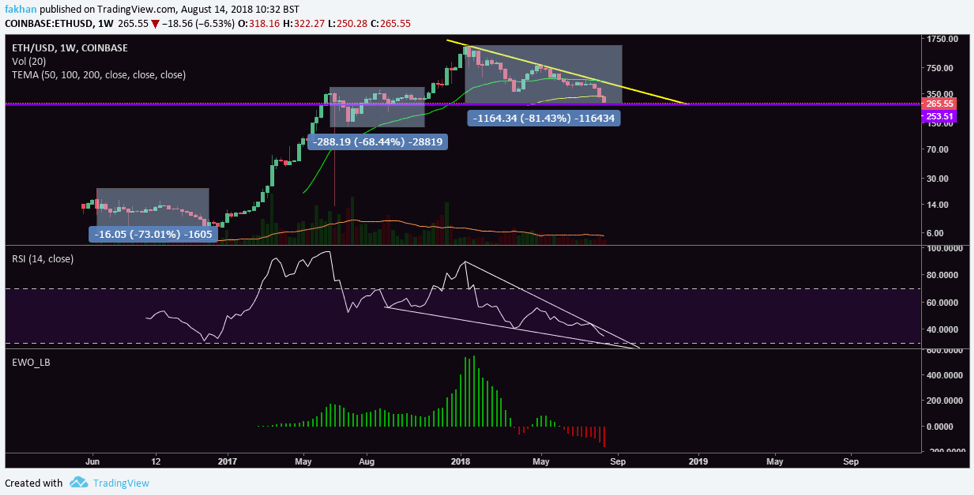

Ethereum (ETH) has now undergone the worst correction in its history. The price is down more than 81% since its all time high and could fall even further as indicated by the ETH/USD weekly chart above. The RSI level for Ethereum (ETH) is well in the oversold region but it has just bounced off a resistance and can be expected to fall further to touch the lower limit of the falling wedge that the RSI is trading in. It is pertinent to note though that the price has now traded further along the falling wedge such that a breakout can be expected anytime within the next 2 to 3 weeks.

The Elliot Wave Oscillator profile on the above chart points to a similar scenario. The EWO diagram shows that the price can be expected to fall further to complete the cycle. However, it also shows that the momentum with which the bears have pushed the price down is now lost. That does not mean though that the bulls are out of the gates but it they will likely show up once the price succeeds in breaking its downtrend against the US Dollar. The yellow line on the above chart shows how Ethereum (ETH) has failed to breach the downtrend resistance since the beginning of this correction.

However, this time it has gotten close to a decision point where it will have to break above or below this triangle. The most likely scenario, in light of all technical and fundamental indicators is that the price will break above the triangle in the weeks ahead. As with most altcoins, this period of breakout can be expected before the beginning of September. However, in the case of Ethereum (ETH) recovery could be a bit slow compared to the rest of the altcoins that have suffered more losses comparatively.

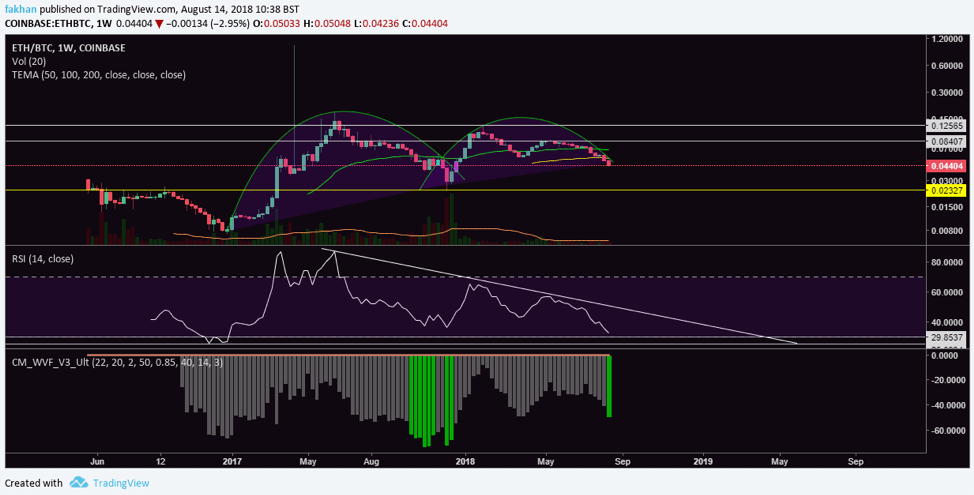

The above weekly chart for ETH/BTC looks very favorable for a breakout in the near future. As the RSI diagram shows, the chart still has a lot of room for further downside. This makes Ethereum (ETH) different from most altcoins that have already reached the full extent of their correction. One reason for this could be that Ethereum (ETH) continued to make gains till the last few weeks before the correction while most altcoins had already started to bleed.

The VIX profile for Ethereum (ETH) shows that it has touched the first possible zone of a bottom as indicated by the green bar on the above chart for ETH/BTC. However, it could trade sideways for a while before finding a true bottom. Overall, the price seems to have come closer to the end of this correction, but if capitulation kicks in, the price can fall down to 0.023 BTC. Near term resistances for ETH/BTC are at 0.084 BTC and 0.125 BTC. The volume of Ethereum (ETH) has dropped down to extremely low levels on most exchanges. Some ICO projects still hold significant amounts of Ethereum (ETH) and if they decide to dump their coins on exchanges like Bitfinex, as they have done in the past, it will make it very difficult for Ethereum (ETH) to make further gains during its next cycle.