- Bitcoin buyers face significant resistance at $6,600 but the support at $6,300 has been instrumental.

- Investors can now trade Bitcoin ETNs via OTC brokerage accounts provided by NASDAQ Stockholm.

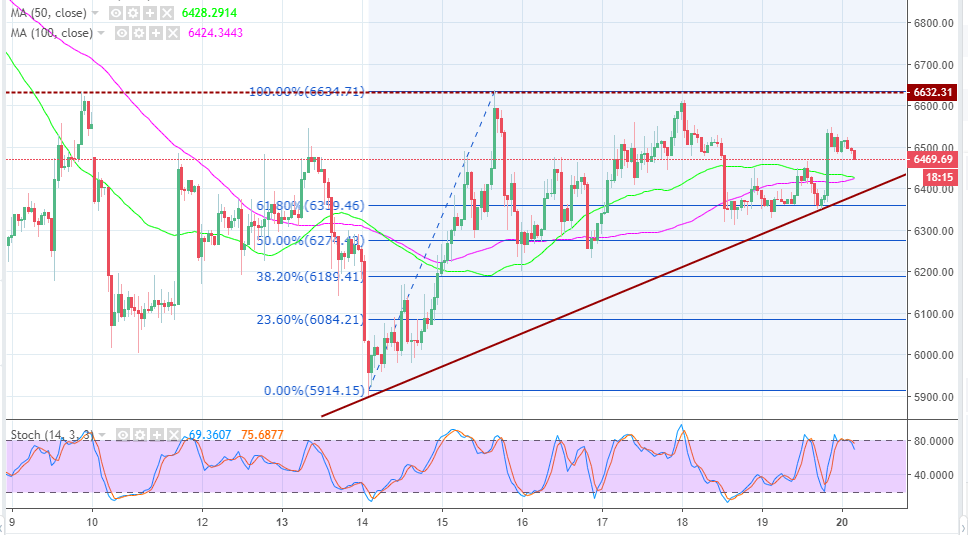

Bitcoin price keeps coming to halt at the critical resistance level at 6,600, followed by lower corrections towards the key support at $6,300. The price is forming a classic rising wedge pattern on the BTC/USD chart. Trading over the weekend saw Bitcoin retrace steps past the pivotal $6,500 and broke the above resistance but the crypto lost momentum around $6,610. The lower corrections that followed found support at the 61.8% Fib retracement taken from the highs of $6,634.71 and lows of $5,914.15.

The buyers intensified their attacks and BTC/USD pulled backed in a bullish engulfing candle above the short-term resistance at $6,400 and exchanged hands above the pivotal at $6,500. However, it created highs around $6,545 before reacting lower again. Bitcoin is currently trading at $6,483 while the trend is generally bearish. The 100 SMA is advancing to cross above the short-term 50 SMA and the stochastic on the one hour chart is heading south to confirm the bears’ influence.

The path of least resistance is to the south at the time of press, but the upside is limited at $6,500. Further up, Bitcoin buyers must brace themselves for the difficulty at the critical $6,600. It is vital that they find a support above the critical level before forging ahead to the medium-term resistance at $6,800. On the downside, BTC/USD will short-term support at $6,400, but the stronger support is at the above mentioned 61.8% Fibo and $6,300.

In other news, Bitcoin ETFs are not yet a reality, but at the moment there is Bitcoin Tracker One, although it is available for trading via the broker’s OTC market. This is a silver lining for investors who were looking forward to Bitcoin ETF. They can invest their USDs in Bitcoin using exchange-traded notes or otherwise known as ETNs (Bitcoin Tracker One).

NASDAQ Stockholm is offering these investment opportunities on US brokerage accounts via an Over the Counter market in form of foreign debt instruments. The firm holds the BTC on behalf of the customers hence an element of custodial risk. Moreover, Bitcoin Investment Trust is also available on an OTC platform that is controlled by Grayscale Investments.

Get 24/7 Crypto updates in our social media channels: Give us a follow at @FXSCrypto and our FXStreet Crypto Trading Telegram channel