Since the Reserve Bank of India (RBI), the country’s central bank, banned banks from providing services to cryptocurrency businesses, traders are increasingly trading on peer-to-peer (P2P) platforms. Local crypto exchanges have come up with a number of exchange-escrowed P2P solutions.

Also read: Yahoo! Japan Confirms Entrance Into the Crypto Space

Localbitcoins

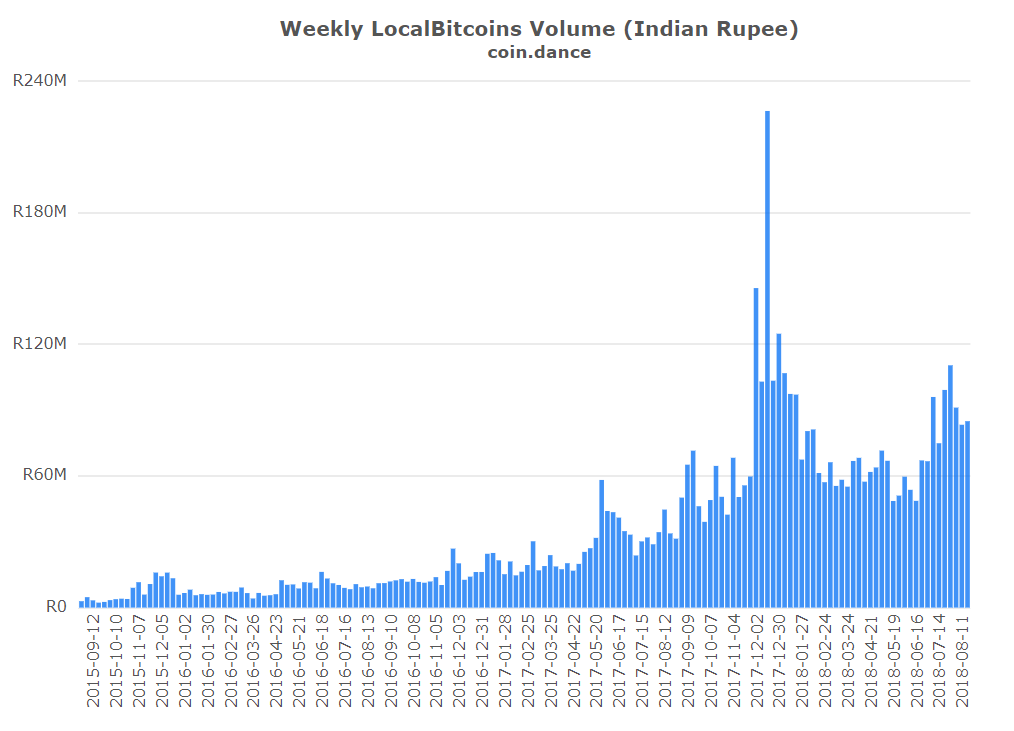

Trading volumes in both the Indian rupee (INR) and BTC increased on Localbitcoins between the week of April 7, when the RBI issued its circular, and the week of August 18. The INR trading volume increased 25 percent, from 68 million rupees (~US$974,561) to 85 million rupees (~$1,218,201). The number of BTC traded increased about 23 percent from 150 BTC to 184 BTC.

Earlier this month, news.Bitcoin.com reported that Indian traders have also found some other creative ways to trade cryptocurrencies amid RBI’s ban including Dabba trading via Telegram.

Exchange-Escrowed Marketplaces

The Mumbai-based Koinex is offering an exchange-escrowed P2P service called Loop for the trading of BTC, ETH, and XRP. Founder and CEO Rahul Raj explained to Inc42 that “buyers and sellers on Loop can create their own listings (like a marketplace) or explore existing listings to choose their best trades.”

The Mumbai-based Koinex is offering an exchange-escrowed P2P service called Loop for the trading of BTC, ETH, and XRP. Founder and CEO Rahul Raj explained to Inc42 that “buyers and sellers on Loop can create their own listings (like a marketplace) or explore existing listings to choose their best trades.”

He elaborated, “while it’s still early days, Loop has been very well received by the Indian trading community and we are seeing increasing traction every day,” adding:

Other key aspects of Loop include a user rating mechanism, cancellation option for sellers, listing modification, dynamic pricing, cleansing of stale listings, and a host of other features to ensure only genuine and legitimate trading on the platform.

Another crypto exchange, Coindelta, has created an exchange-escrowed P2P system called Flux. BTC, ETH, XRP, and USDT can be transferred directly between Coindelta and Flux, but other cryptocurrencies must be converted to USDT on Coindelta before sending to Flux.

Auto-Matching Orders

The Wazirx P2P system uses USDT in transactions. Sellers convert their cryptocurrencies to tether and sell them for rupees and buyers convert their rupees into tether to trade on the exchange. “Wazirx acts as an escrow account for holding the cryptos during the transaction,” the exchange described.

The Wazirx P2P system uses USDT in transactions. Sellers convert their cryptocurrencies to tether and sell them for rupees and buyers convert their rupees into tether to trade on the exchange. “Wazirx acts as an escrow account for holding the cryptos during the transaction,” the exchange described.

Orders are automatically matched by the exchange, CEO Nischal Shetty told news.Bitcoin.com:

The auto-matching open order book in P2P has never been attempted before and people love the ease.

Furthermore, Wazirx tweeted on August 25, “Wazirx has the cheapest price for crypto in India.”

Incentives for Depositing INR

Crypto exchange Bitbns also recently launched P2P transaction functionality which has been updated several times. Last week, the company announced an incentive scheme for anyone depositing INR in order to speed up order matching. The exchange explained:

We have introduced an option that allows withdrawers to tip depositors as per their wish. The tip could be anything in the denominations of 0.1 i.e 0%, 0.1%, 0.2%, 0.3%, and so on up to 1% of the transaction amount.

However, some users have complained on social media about not being able to withdraw funds. Some also said that they have been scammed on the exchange’s Telegram group by people pretending to be Bitbns’ admin.

Disclaimer: Bitcoin.com does not endorse or support claims made by any parties in this article. None of the information in this article is intended as investment advice, as an offer or solicitation of an offer to buy or sell, or as a recommendation, endorsement, or sponsorship of any products or companies. Bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

What do you think of these trading options? Let us know in the comments section below.

Images courtesy of Shutterstock and Coin.dance.

Need to calculate your bitcoin holdings? Check our tools section.