It has been a testing year for ICOs. Market conditions have made launching a tokensale more challenging than a year ago, when even the most ludicrous project was virtually guaranteed a $10 million raise. Several of 2018’s most successful ICOs, based on millions raised, have degenerated into its most disastrous, after plotting a journey from champagne to real pain in just a few short months.

Also read: Crypto Exchange Okex Introduces Stricter KYC Rules

From Winners to Losers in Under a Year

For many of this year’s worst performing ICOs, the bear market is an all too-convenient excuse for destruction. Some ICOs are born bad, while others achieve badness through a series of inexplicable decisions, poor communication, lack of marketing, no MVP and downright greed. These factors can quickly combine to sink seemingly successful projects soon after their triumphant launch. Market conditions can’t paper over all of the cracks, as an examination of five of this year’s worst performers shows. A series of icebergs can be attributed to their titanic failure that left investors seething.

Gems

Gems was one of the most hyped projects of the year, successfully building huge levels of fomo and a huge Telegram group. Led by brothers Rory and Kieran O’Reilly – Harvard dropouts both – Gems billed itself as a ‘decentralized mechanical turk’. To become whitelisted for Gems, investors had to share the project on a social network, write a blogpost, or promote the ICO in some other way, effectively performing the duties of unpaid mechanical turks for the privilege of getting to hand over their hard-earned ether.

Only once whitelisted did Gems reveal to these hard-working investors that the ICO would be conducted via Dutch auction in order to extract the maximum amount of money possible from each of them. To help them visualize the process, they produced a handy graphic of a brightly-colored pink vice squeezing their wallets dry. Eventually, this plan was canceled in favor of a more conventional private sale. Here, Gems successfully raised as much as $150 million, but lost much of the support of the crypto community in the process. The team also opted to keep an insane 75% of tokens to themselves. If you had invested $1million in Gems during their ICO those tokens would now be worth less than $18,000. Gems managed to conduct an ICO so mind-bogglingly awful that investors would have literally been better off laboring as mechanical turks.

Bee Token

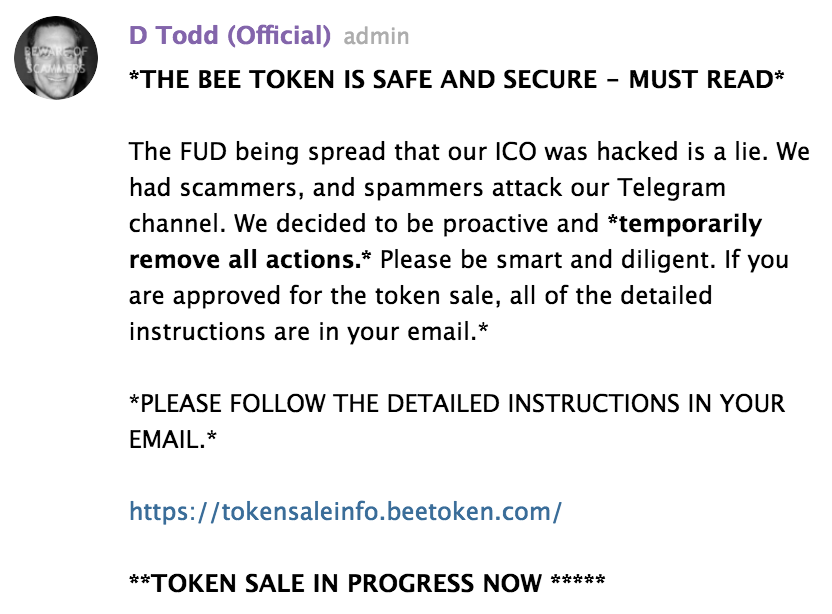

The Bee Token crowdsale was a huge success story right up until the moment it started. Dubbed as a decentralized Airbnb, Bee became one of the most oversubscribed ICOs of the year. Having built an engaged and passionate community, conducted KYC for the whitelist, and set a low contribution limit of 0.2 ETH, everything seemed to be in place for a successful ICO offering. However, hackers somehow snatched the Bee Token whitelist and sent out phishing emails on day one of the ICO.

As the day unfolded, and with hundreds of investors already stung in the well-orchestrated scam, the Bee Token team downplayed the incident on social media, reporting, “The Bee Token has received reports of fake emails, Telegram accounts, etc. claiming to represent the Bee Token ICO Crowdsale”. It was a statement of infuriating understatement for many, who saw the hack as a damning indictment of overall security procedures at Bee Token. Although the ICO eventually recovered well enough to hit its hard cap, the handling of this incident did nothing to instill wider confidence in the project. Today the total value of the Bee Token colony has collapsed to just 0.06x its initial ICO valuation.

Rentberry

A bizarre name and a bizarre concept of ‘investing’ in property rental security deposits wasn’t enough to stop Rentberry from successfully raising close to $30m in funding. As an existing business with experience in the real estate market, Rentberry at least had some kind of foothold in the industry they sought to disrupt. However, a limited MVP and a marketing campaign that some investors saw as substandard meant that BERRY tokens proved to be of little security at all, holding just 0.03x of their initial valuation. That means if you’d deposited $1,000 into Rentberry during ICO you’d only have $30 today; scarcely enough to cover a deep carpet clean, let alone a property deposit.

A bizarre name and a bizarre concept of ‘investing’ in property rental security deposits wasn’t enough to stop Rentberry from successfully raising close to $30m in funding. As an existing business with experience in the real estate market, Rentberry at least had some kind of foothold in the industry they sought to disrupt. However, a limited MVP and a marketing campaign that some investors saw as substandard meant that BERRY tokens proved to be of little security at all, holding just 0.03x of their initial valuation. That means if you’d deposited $1,000 into Rentberry during ICO you’d only have $30 today; scarcely enough to cover a deep carpet clean, let alone a property deposit.

Narrative Network

A content-creating site with crypto payments, Narrative Network was dubbed as ‘the next Steem’ before it failed to gain any. While hindsight offers easy wisdom, Narrative Network may rue the day they decided to switch from the Ethereum blockchain to Neo. The reasons for the change seemed at least semi-logical, with concerns about scalability and transaction time being muted by CEO Ted O’Neil. There were also risks, since conducting an ICO on the NEO blockchain was something few had done before. There’s a reason why so many ICOs choose Ethereum despite its problems, not least that it is a tried and tested standard that is supported by most exchanges and a sizeable developer community.

In the end, the risks posed by Neo bore fruit in the form a node processing discrepancy. The ‘solution’ came in the form of scrapping the crowdsale two days before launch, burning the 20 million NRV tokens issued and starting again with a new NRVE token. In the delayed crowdsale, Narrative Network still managed to raise $14m of their $22.8m funding target. The Narrative Network team then decided to go ahead with their plan to retain 50% (20% for team, 30% for development) of all tokens minted, meaning that out of a total of 82 million NRVE tokens, 50 million are in the possession of the team. A disastrous ICO and accusations of company greed mean that NRVE tokens are now worth 0.06x their initial dollar value.

Iungo

Iungo is a project with a logo that looks like a poor man’s Nano, a name that is pronounced with a y as in ‘yungo’ and that, when capitalized, looks like it should read ‘Lungo’ rather than ‘iungo’. In this way, Iungo created the perfect storm of brand confusion that you’d expect from a token worth just 0.02x its initial value. Advertised as a decentralized wifi network, the Ungo/Lungo/Yungo MVP has still to released, but its team maintains that the value of ING will increase when the token has some actual utility.

Iungo is a project with a logo that looks like a poor man’s Nano, a name that is pronounced with a y as in ‘yungo’ and that, when capitalized, looks like it should read ‘Lungo’ rather than ‘iungo’. In this way, Iungo created the perfect storm of brand confusion that you’d expect from a token worth just 0.02x its initial value. Advertised as a decentralized wifi network, the Ungo/Lungo/Yungo MVP has still to released, but its team maintains that the value of ING will increase when the token has some actual utility.

There’s no doubt this enduring bear market, exacerbated by ICO overcrowding, has made conditions worse for all tokensales – even those that have merit. A strong idea, clear vision, MVP, and go-to market strategy are no guarantee, but they do offer more hope than projects that rely on fomo and audacious promises to generate interest. If the ICO economy ever recovers, hopefully the next wave of projects will be funded by savvy investors who do their own research and don’t believe the hype.

Do you think ICO investors have learned to be shrewder with their selections? Let us know in the comments section below.

Images courtesy of Shutterstock, Gems, Narrative, and Twitter.

Need to calculate your bitcoin holdings? Check our tools section.