Joost van der Burgt, a policy advisor at the Dutch National Bank, said that the Bitcoin price will endure at least one more correction prior to initiating the next mid-term rally.

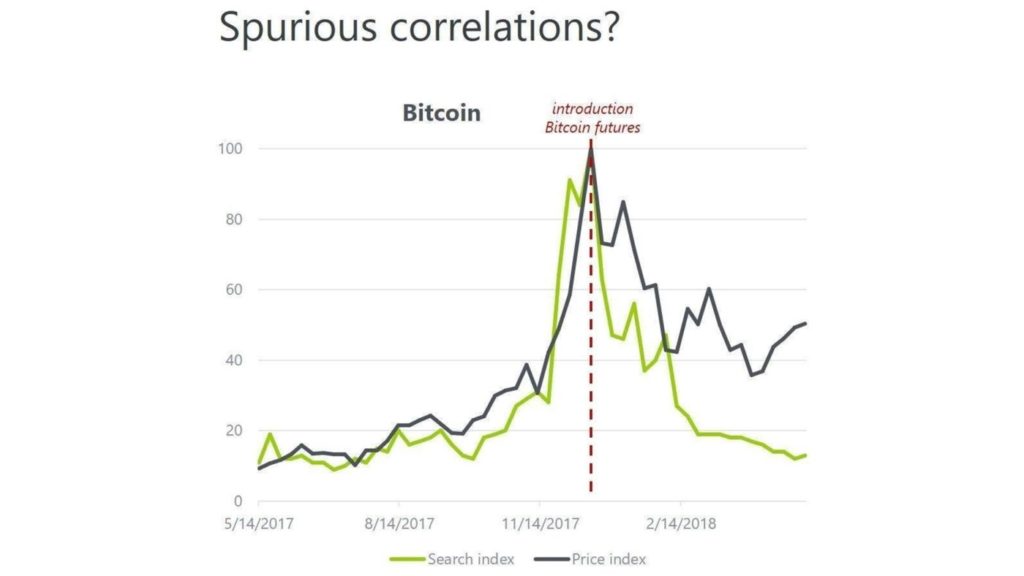

Burgt demonstrated the correlation between Google search activity of the keyword “Bitcoin” and the price chart of BTC, which showed striking similarities from May of last year to February of 2018. But, over the past seven months, Bitcoin has not reflected the trend of Google search.

“Every time bitcoin was in the news, be it positive or negative, the price went up accordingly. My take on it is that because of the introduction of futures, that might have deflated the bubble before it got to a level where it might burst completely,” Burgt said.

Is a Major Drop Really Likely?

In April and July, the price of BTC spiked to $10,000 and $8,500 respectively subsequent to recovering from the $6,000 support level. Both spikes were triggered by an abrupt surge in volume and within a day, on both occasions, the price of BTC surged from $6,000 to over $7,500.

But, as seen in the chart provided by Burgt, the correlation between Google search trend of Bitcoin and the BTC price chart has dematerialized since February. In April, when the price of Bitcoin achieved $10,000, the search trend was on a continuous decline, despite significant optimism demonstrated by the market at the time.

It can be argued that the stability in the price of Bitcoin and its lack of movement in the lower price range led the popularity of the keyword BTC on search engines to subside. Because the demand for Bitcoin was so intense during December of last year when the futures market around Bitcoin was introduced and BTC achieved an all-time high price at $19,500, interest towards cryptocurrencies have declined since then.

Burgt acknowledged that the BTC price and Google trends for the keyword Bitcoin were almost a perfect match until the end of 2017.

In the latter half of 2017, newspapers, mainstream media outlets, and television networks were all actively reporting about the cryptocurrency sector with some major regions like South Korea and Japan broadcasting debates on digital assets on national television.

Even if the Bitcoin price recovers to $20,000 in the months and years to come, it is unlikely for Google trends to demonstrate similar interest as 2017 was the year Bitcoin was introduced to the mainstream for the first time at a massive scale.

According to Burgt, the unprecedented growth rate of Bitcoin and rapidly rising interest led investors to become scared about the mania round cryptocurrencies, forcing investors to sell the asset.

“If the buzz is everywhere, it doesn’t matter exactly what the news is about… nobody wants to miss out and everybody’s trying to get a piece of it. It wasn’t really panic, it was more of a scare,” he added.

Lack of Correlation

The correlation between Google trends and the BTC price faded in early 2018, as the global market moved on from the 2017 highs of cryptocurrencies. Hence, it is unlikely that the trend shown by Google will be reflected by the price chart of Bitcoin in the upcoming months.

Featured image from Shutterstock.

Follow us on Telegram or subscribe to our newsletter here.

• Join CCN’s crypto community for $9.99 per month, click here.

• Want exclusive analysis and crypto insights from Hacked.com? Click here.

• Open Positions at CCN: Full Time and Part Time Journalists Wanted.