Dash (DASH) may not be a game changer like Bitcoin (BTC) or Ethereum (ETH). Some may even call it a spin off coin or a copycat. However, there is no denying that Dash (DASH) has succeeded in such a level of mass adoption with its only use case being a spendable cryptocurrency. This has led many to believe that even if Dash (DASH) fails in the long run, it might still have succeeded in creating awareness, adoption and solving a real problem. Let’s face it, Bitcoin (BTC) and Ethereum (ETH) are both wonderful cryptocurrencies but they were not created to solve the spending problem. Bitcoin (BTC) was created to solve the double spending problem.

Initially some people used Bitcoin (BTC) to buy electronics or order food online but later when they realized how its value appreciated over time; they were reluctant to use it. This created a spendability problem which Dash (DASH) set out to solve. A lot of merchant across the globe accept payment in Dash (DASH), which is short for “Digital Cash”. Some people may argue that cryptocurrencies were not created to solve spendability problem and that many people had no problem paying for their cup of coffee with a credit card or Paypal before. This may be true for some people, but consider the vast majority of people across the globe that does not have access to such services. For them, Dash (DASH) and cryptocurrencies like it have made things a lot easier.

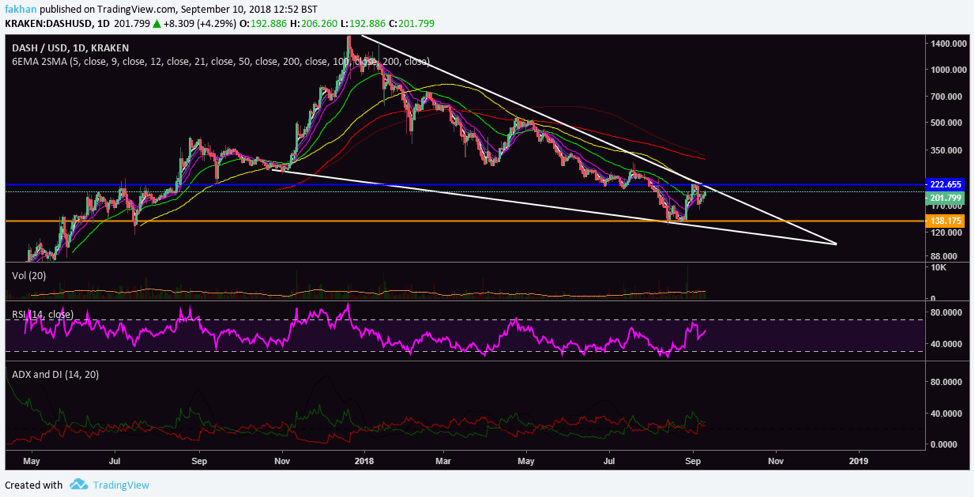

Dash (DASH) like many altcoins have been trading in a giant falling wedge since the beginning of this correction. However, its absence on futures markets has made its behavior somewhat different than other top altcoins. Its use by online vendors and merchants is another factor. The above chart for DASH/USD on the daily time frame shows that Dash (DASH) has just run into a resistance but the bulls do not have the momentum to break it at this point. The price is likely to fall back to the bottom of the falling wedge after testing the downtrend resistance at the top of the falling wedge. ADX and DI indicators for DASH/USD also point to a strong possibility of an imminent retracement.

Dash (DASH) has followed nearly the same pattern of trading against Bitcoin (BTC) as it has against the US Dollar (USD). The above daily chart for DASH/BTC shows that the price of Dash (DASH) is likely to retrace back into the falling wedge towards the bottom once it gets rejected at the downtrend resistance. Just like the DASH/USD daily chart, the ADX and DI indicators on this chart also point to a strong possibility of an upcoming retracement. Dash (DASH) does not have the momentum to break the downtrend at this point without falling back to the bottom of the falling wedge. The same behavior is also exhibited by coins like Litecoin (LTC) which have an equally uncertain future as Dash (DASH). It may have had an early movers’ advantage and it may have set out to solve the spendability problem but if projects like Dash (DASH) keep entering the market, where does it stop? This creates the same problem of double spending that Bitcoin (BTC) set out to solve.