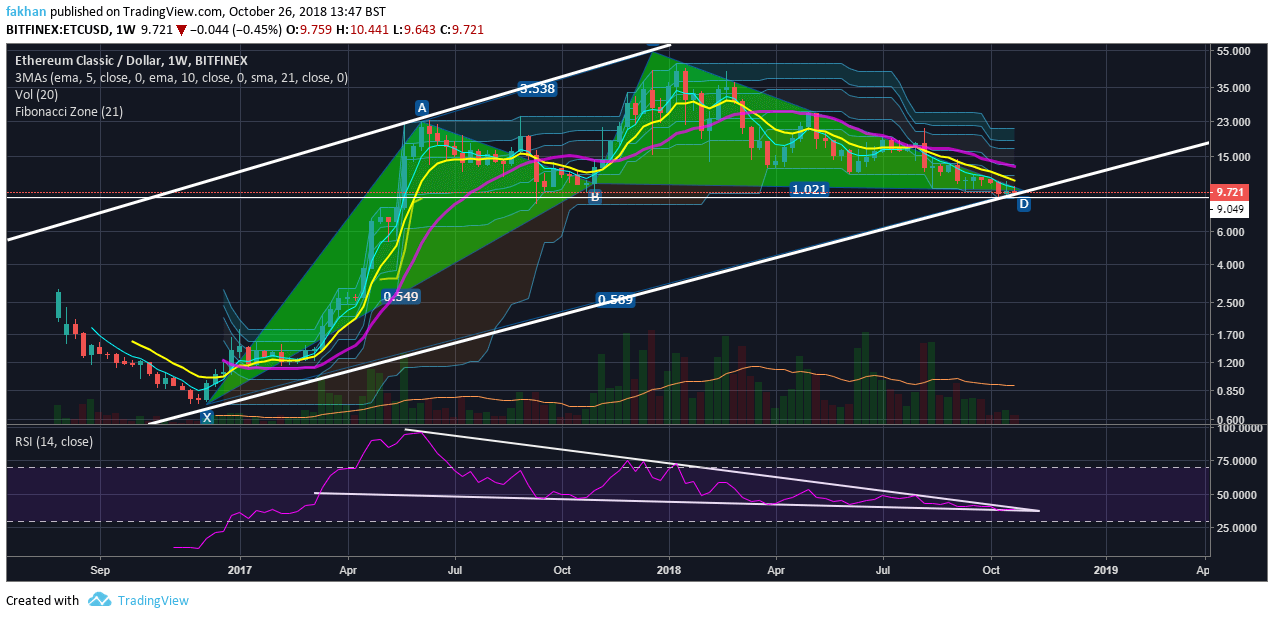

Ethereum Classic (ETC) has recently shown signs of strength after an unprecedented shift in market sentiment and acceptance towards the coin. The cryptocurrency which was previously considered a dead coin or a scam is now being seen as a game changer. If it were not for these developments, Ethereum Classic (ETC) would most likely have broken market structure and would be lagging behind in the altcoin run this year, same as it did last year. However, the listing on Coinbase, success of ETC Summit and exciting upcoming events has convinced investors of its future potential. On the technical front, Ethereum Classic (ETC) is poised for an explosive breakout. The above chart for ETC/USD shows that the 10 Week EMA has now come very close to the 21 Week EMA. One strong move up might shift the sentiment in favor of the bulls for a very long time.

Previously when Litecoin (LTC) and Bitcoin Cash (BCH) were added to Coinbase, mainstream investors did not know about it before the day of listing. However, in case of Ethereum Classic (ETC), Coinbase made the announcements in advance. Therefore, it did not result in the same sort of FOMO buying that we witnessed in the case of Litecoin (LTC) or Bitcoin Cash (BCH). However, the effect is yet to factor in and as the market recovers, we will see a strong buying interest in Ethereum Classic (ETC). Even before the Coinbase announcement, most analysts put out a price target of $100+ for Ethereum Classic (ETC) by the end of the year. Tom Lee of Fundstrat announced a target of $70+ for Ethereum Classic (ETC) well before the Coinbase announcement.

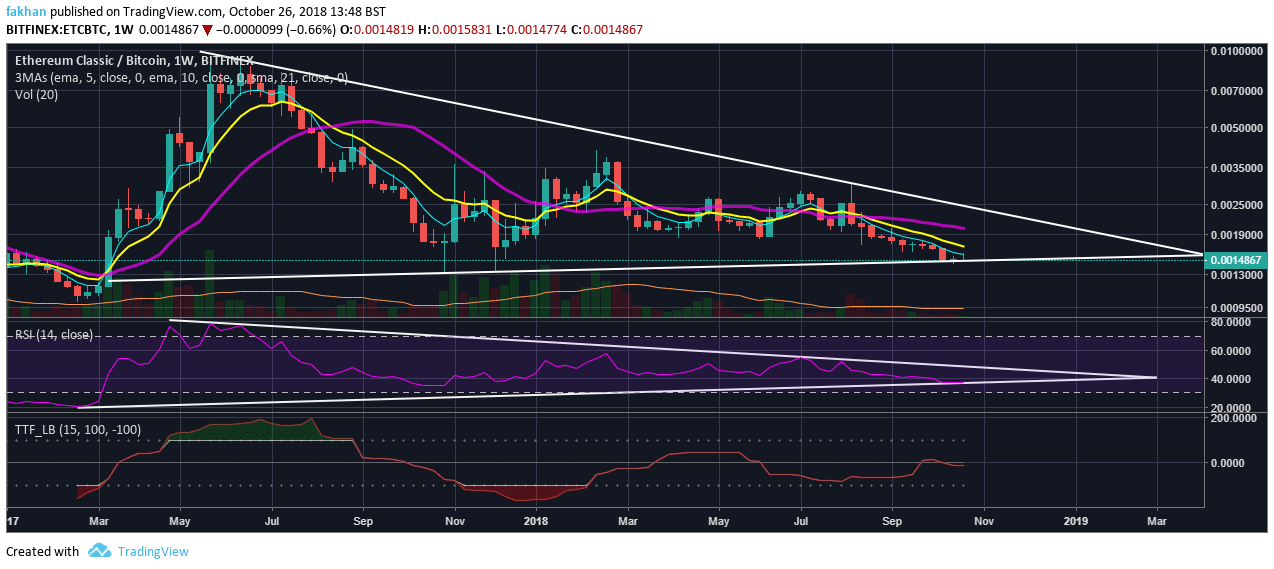

Chart for ETC/BTC (1W)

Some investors may not like Coinbase or the influence it has over the market. Majority of investors with this view are those who were disappointed when Coinbase listed Ethereum Classic (ETC) instead of Ripple (XRP). However, the fact remains that even today Coinbase has a lot of influence over the markets. Anything that ends up on Coinbase has the potential to end up in the wallets of millions of Coinbase users. If that asset is priced significantly lower than other cryptocurrencies on Coinbase, then it has the potential to be bought up the most. We saw the same thing with Bitcoin Cash (BCH) and Litecoin (LTC).

The difference this time is that unlike Litecoin (LTC) or Bitcoin Cash (BCH), Ethereum Classic (ETC) is not just another cheap cryptocurrency. It is a project of the future that is actually aimed at solving real issues. Instead of focusing on hosting a large number of ICOs on its blockchain, Ethereum Classic (ETC) is focused on building a stable blockchain that is capable of running IOT (Internet of Things) applications. Some might argue that there are other blockchains like Ethereum (ETH), Eos (EOS) or IOTA (MIOTA) that can also run IOT applications. However, the fact remains that those blockchains are neither decentralized nor immutable as Ethereum Classic (ETC). Those are the two primary prerequisites for any decentralized application. Moreover, from an investment perspective, Ethereum Classic (ETC) has a limited supply just like Bitcoin (BTC) and is therefore only going to appreciate in value in the years to come.