JD.com, one of the largest and fastest growing online market places in China, got crushed this year. Top to bottom, this year, the stock with symbol JD lost 57 pct. Talking about a crash. Last week there was a first sign of strength. Is JD a stock to buy or sell now? The most likely answer is ‘yes’ provided that our China Stock Market Forecast For 2019 comes true.

JD stock buy signal from May got invalidated

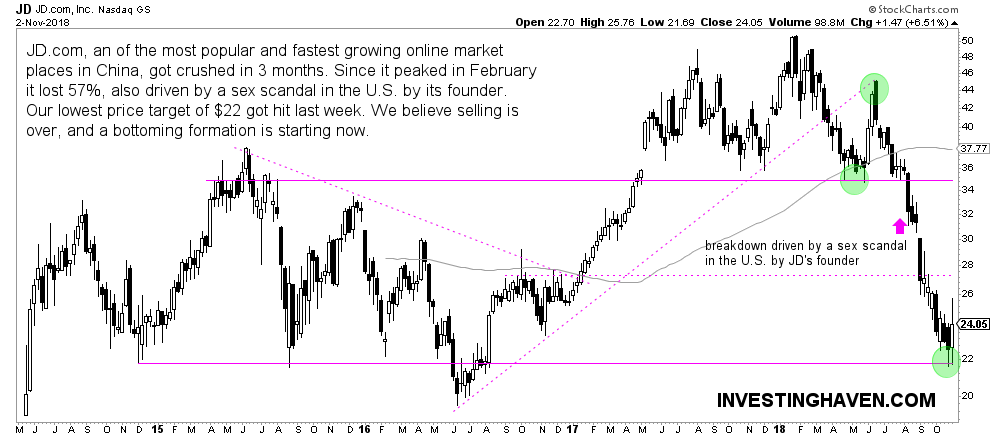

Admittedly, our prediction from earlier this year was not accurate. We wrote in May. JD.com, Chinese Giant Internet Stock, May Be Firing A Buy Signal. The point we made was that the odds favored that $35 would hold, as support, and, if so, it would trigger a buy alert.

As always, there is a flipside to every story in markets. We wrapped up that article with this quote:

This is a classic case which needs some attention, and weekly followup, before engaging in a trade. Patience, as said many times, will be rewarded, and JD is a textbook example to illustrate this.

JD went up, only to fall back to $35 in July. We thought indeed that another buy signal was about to get triggered.

However, what happened in August, was disastrous. Instead of support at $35 holding strong it went the opposite direction, fast and furious. The breakdown which was triggered by China’s aggressive tech stock sell-off got accelerated by a sex scandal by JD.com’s big boss, who got arrested in the U.S. for rape of a young woman after a party. JD.com CEO, under investigation for rape allegation, skips China forum says Reuters referring to the facts on August 31st.

So the breakdown at $35 was triggered by the general industry sell-off, while the sex scandal accelerated it even below the lower support level at $28.

That’s how fast things can turn.

Our fundamental analysis from May became worthless. The market decided otherwise.

The situation becomes ultra-bearish: bad news is bad news, and good news is ignored.

JD stock: fundamentals vs chart

Articles like this one on the WSJ Billionaire Founder Locked Up? JD.com’s Board Can’t Meet Without Its Mighty Boss make things worse, obviously. A negative spiral follows, with price target cuts like this one JD.com target cut to $32 at Stifel.

The good news like this one end of September JD.com to Open 1,000 Supermarkets in China or this one China’s JD.com unwraps FedEx-style parcel business to bolster sales mid-October are completely ignored.

During a sell-off there is only one direction, and that is south.

This is a case of the power of the chart crushing fundamentals. The chart and the market always win, and fundamentals may or may not reign.

Is JD stock a buy?

If China’s stock market stabilizes here, and goes higher (SSEC above 2600 points), we expect the selling pressure in China’s internet stocks to be over. This would give room to JD for a strong rally, short and medium term. It may provide very strong results over the next 12 months.

Who dares to buy after such pessimism?

TOP CRYPTOCURRENCIES TO BUY: InvestingHaven’s top crypto tips are in a “buy zone”. Top notch guidance on how to play the grand bull market in crypto from InvestingHaven’s research team, only for $2 per week. Crypto & Blockchain investing service >>