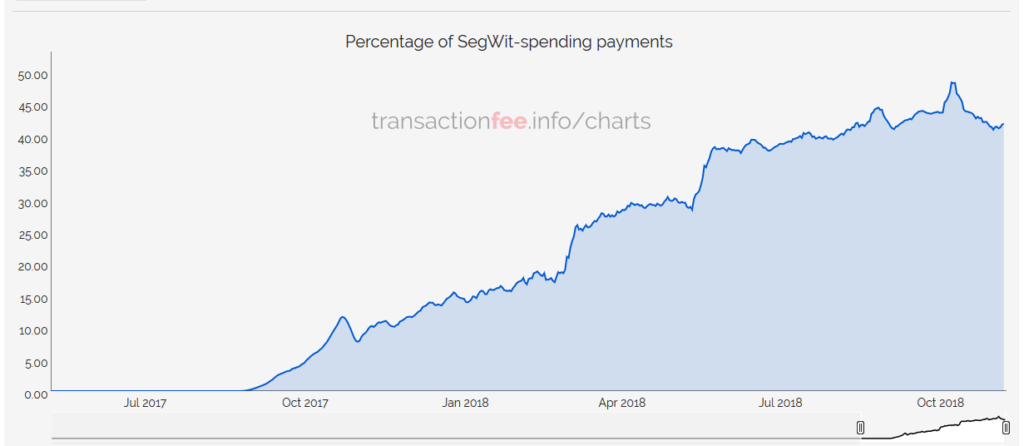

Blockchain detectives and Lightning Proponents may have noticed a severe drop in SegWit blocks near the end of last month. SegWit-spending transactions had reached a high of nearly 50% of all transactions, according to this tracker, but around about October 20th the rate began to drop off, hitting a low of nearly 40%.

Users who noticed might have been mystified – if those many people were previously spending SegWit-enabled inputs, why would they suddenly stop? SegWit transactions generally cost less as they are smaller in actual size, and therefore it is less expensive to send them with priority.

A Bitcoin newsletter familiar with the deep technological aspect of Bitcoin has a theory that makes sense: at least one major mining pool accidentally stopped processing the transactions.

A simple explanation for this sudden decrease and rebound could be a minor misconfiguration. By default, Bitcoin Core does not produce segwit-including blocks in order to maintain getblocktemplate (GBT) compatibility with older pre-segwit mining software. When miners change their software or configuration, it’s easily possible to forget to pass the extra flag to enable segwit. To illustrate how easy it is to make this mistake, the example below calls GBT with its default parameter and its segwit parameter—and then compares the results by the total potential block reward (subsidy + fees) each block template could earn.

SegWit Pushing Toward Being the Norm

Segregated Witness, or SegWit for short, is a scaling solution pioneered Pieter Wuille, Eric Lombrozo, and Johnson Lau. SegWit separates data from blocks that was previously included in such a way that many more transactions are able to fit into a single block. A side benefit was a requisite increase in the size of blocks themselves, although many miners do not process blocks larger than 1MB.

SegWit was one of a few answers to network congestion in Bitcoin and played a big role in the great scaling debates of 2015 to 2017. Combined with Lightning Network, SegWit is Bitcoin Core’s answer to the scaling problem: offchain transactions and more efficient blocks means a better network overall, in their view. Another camp of people believed that the first and most important change to the protocol should be an increase in the size of blocks, and this philosophy eventually led to the hardfork and creation of Bitcoin Cash.

Over the past 13-14 months, SegWit transactions have steadily increased, such that now as many as 1 in 2 transactions is SegWit-based or enabled. It is plain to see that as time goes on, SegWit will be the norm, and secondary enhancements to the network like Lightning will enable regular users to save money and save resources for the network. Lightning is far from the last scaling solution in Bitcoin. Other sidechains such as Liquid have already come about.

Featured image from Shutterstock.

Follow us on Telegram or subscribe to our newsletter here.