Nvidia Corp., one of the biggest manufacturers of chips for computer graphics cards, gave their sales forecast on Thursday, November 15, 2018, revealing the loss of demand that happened as a result of the decrease in cryptocurrency mining. According to the financial results for the third quarter of the 2018 fiscal year.

The California-based company’s stock fell as much as 19%, as they also reported that their revenue was lower than expected. Nvidia has actually been on a hot streak in recent years. The company has seen its share price shoot up from $12 in 2012 to an all-time high of $289.36 per share on October 1, 2018.

A significant part of this rise was due to speculation, but most of it came from increased demand for the company’s graphics chips, which are seen as the industry standard for gaming devices, cryptocurrency mining operations, and data centers. Nvidia said that revenue rose 2.5% to $3.18, which fell short of its previous guidance as well as analysts’ estimates. However, their net income of $1.84 was able to beat the $1.71 a share that was forecasted by Wall Street analysts.

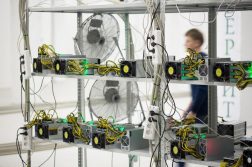

Most of this revenue lag is said to have come from the reduction on crypto mining. Due to the fall in the value of cryptocurrencies like Bitcoin since the turn of the year, the demand for Nvidia’s processors used to mine cryptos have also plummeted. A consequence of this is that Nvidia has been left with higher inventories that they initially expected.

In a conference call, Jensen Huang, Nvidia’s founder, and CEO, said the company was caught off guard as “the crypto hangover lasted longer than” expected, adding that “when prices went down, we expected demand to pick up more quickly.”

Huang later admitted on the call that the company thought it “had done a better job managing the cryptocurrency dynamics.”

The company said revenue would be around $2.7 billion, plus or minus two percent. That figure represents a 20% haircut from the $3.4 billion that was forecast by analysts. On the other hand, Nvidia still sees growth in operational aspects like design visualization, which climbed 28%, according to its financial report. As soon as this dark cloud passes, there is a probability that the company’s stock will begin to ascend.

Featured image from Shutterstock.

Follow us on Telegram or subscribe to our newsletter here.