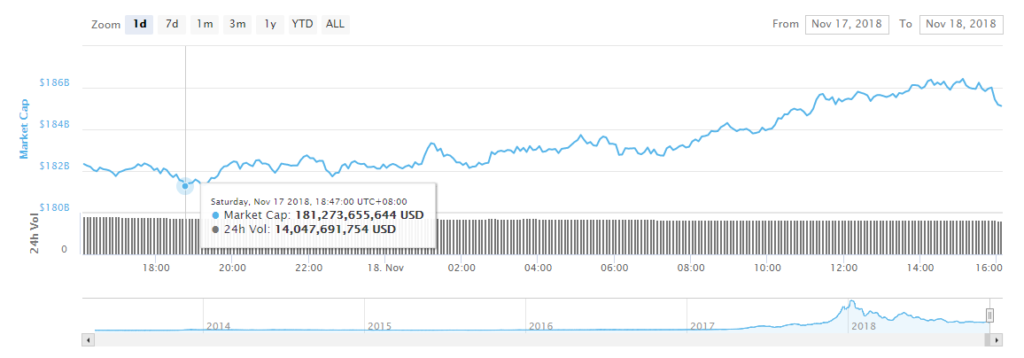

Over the last 24 hours, Ripple (XRP) has surged by more than 8 percent to $0.51, as the valuation of the crypto market increased by $4 billion from $181 billion to $185 billion.

On November 15, the valuation of the crypto market fell by $27 billion from $210 billion and a recovery to the $200 billion mark could require weeks to months of stability.

As one cryptocurrency technical analyst explained, “BTC bulls trading in defense after recent drop below key support, now need a powerful comeback to initiate spring as last resort. further lower lows without violent comeback would indicate prolonged bear market — likewise, failure in printing new lows will attract buyers.”

Two Scenarios For Bitcoin and the Crypto Market

The sheer intensity of the November 15 crash of the cryptocurrency market has limited the number of scenarios in which Bitcoin and the rest of the market could recover by the 2018’s end.

Several recognized cryptocurrency analysts including Willy Woo said that Bitcoin is not likely to breakout of major resistance levels until mid-2019.

Cred, a Bitcoin trader, said that if the price of BTC rebounds to the $6,000 mark in the short-term, a short squeeze could trigger the market to experience a corrective rally.

“If price reclaims $6,000 – $6,200, all shorts below yearly lows are gonna puke/get liquidated. This usually causes a very fast rip up — markets aren’t nice to people who’re wrong.”

There are several positive developments lined up for the BTC market including the BTC futures market launch by Bakkt and ICE, the parent company of the New York Stock Exchange.

Dissimilar to existing futures markets operated by CME Group and CBOE, Bakkt physically delivers BTC to its buyers and as such, Bakkt could have a real impact on the supply of BTC and ultimately, its price.

“ICE entering crypto feels like a big deal. It’s an established, respected & powerful player in the finance industry. In other words, large institutions trust ICE with their money, including those institutional investors who many people think are key to the next bull run. Also noteworthy is the fact that Bakkt will custody & deliver real bitcoin. That means institutional inflows would reduce supply & thus (maybe) increase price too,” Jake Chervinsky, a government enforcement defense and securities litigation attorney at Kobre & Kim LLP, said

This week, a Bitcoin exchange-traded fund (ETF) was approved in Switzerland, a move that could increase the liquidity of BTC in the traditional finance sector of Europe.

Is a Rally Before 2018 Possible?

The volume of BTC has declined back to its $4 billion mark, a level which the dominant cryptocurrency has maintained relatively well throughout the past four months.

Based on current market conditions, a significant surge in the price of major cryptocurrencies is highly unlikely. But, a gradual increase in price due to the anticipation towards Bakkt until early December remains a possibility, especially if Bakkt gains traction among investors in the regulated US market.

Featured Image from Shutterstock. Charts from TradingView.

Follow us on Telegram or subscribe to our newsletter here.