An exchange-traded product tracking an index of five leading cryptocurrencies reportedly will start trading on Switzerland’s Six stock exchange next week. The product will be available to both retail and institutional investors.

Also read: Yahoo! Japan Confirms Entrance Into the Crypto Space

Trading on Six Swiss Exchange

The Financial Times reported on Friday that Switzerland’s Six exchange has given a green light to a cryptocurrency exchange-traded product (ETP). The news outlet elaborated:

The Amun Crypto ETP, which will start trading next week on the Six exchange in Zurich, has been designed to track an index based on the movements of five leading cryptocurrencies.

Six Swiss Exchange is Switzerland’s principal stock exchange, trading a wide range of securities. According to the exchange, ETPs “are secured, bearer debt securities that do not earn interest,” so they “are not subject to the Collective Investment Schemes Act (Cisa) and, as such, are not supervised by Finma.” The exchange has a different category for exchange-traded funds (ETFs).

Six Swiss Exchange is Switzerland’s principal stock exchange, trading a wide range of securities. According to the exchange, ETPs “are secured, bearer debt securities that do not earn interest,” so they “are not subject to the Collective Investment Schemes Act (Cisa) and, as such, are not supervised by Finma.” The exchange has a different category for exchange-traded funds (ETFs).

Hany Rashwan, co-founder and CEO of Amun, explained that the crypto ETP “had been constructed to meet the same strict standards required of conventional exchange-traded products widely used by investors,” the publication conveyed. He was quoted as saying:

The Amun ETP will give institutional investors that are restricted to investing only in securities or do not want to set up custody for digital assets exposure to cryptocurrencies. It will also provide access for retail investors that currently have no access to crypto exchanges due to local regulatory impediments.

Tracked Cryptocurrencies

The underlying investment of Amun ETP is Amun Crypto Basket Index (ticker: Hodl5), its website details. Mv Index Solutions (Mvis) and London-based fintech company Amun Technologies Ltd. launched the index in September. The ETP was subsequently launched by Amun AG, a subsidiary of Amun Technologies Ltd. located in Zug, Switzerland. Mvis is a subsidiary of Vaneck which currently has an application filed with the U.S. Securities and Exchange Commission to list and trade a bitcoin ETF.

Amun Crypto Basket Index “tracks performance of the top 5 crypto assets in terms of market cap and liquidity, providing diversified exposure to the crypto space while using its proprietary methodology to effectively manage the volatility associated with less liquid/smaller crypto assets,” its website describes.

The company explained that the basket excludes cryptocurrencies that are tied to a fiat currency such as tether, are designed to be anonymous such as monero and zcash, lack sufficient liquidity, trade on non-reputable exchanges, or have been traded for less than 6 months. According to the Financial Times, the ETP will carry an annual management fee of 2.5 percent.

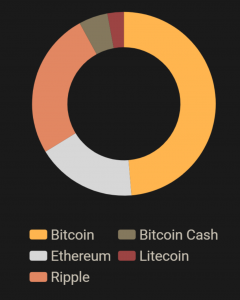

Currently, the basket comprises 48.69 percent BTC, 25.72 percent XRP, 17.60 percent ETH, 5.11 percent BCH, and 2.88 percent LTC. It is rebalanced “monthly to ensure an accurate representation of the current crypto market,” the company explained.

What do you think of this crypto exchange-traded product trading on Six Swiss Exchange? Let us know in the comments section below.

Images courtesy of Shutterstock, Six Swiss Exchange, and Amun Technologies Ltd.

Need to calculate your bitcoin holdings? Check our tools section.