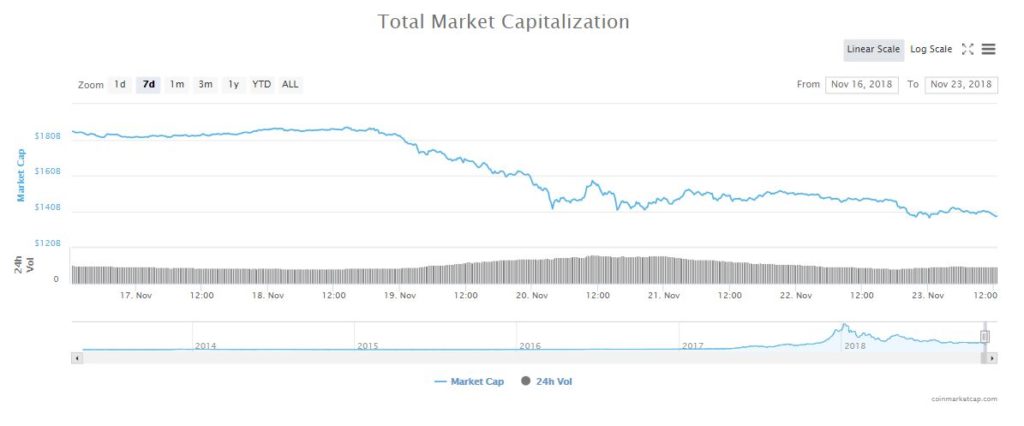

In the past seven days, the valuation of the crypto market dropped from $184 billion to $138 billion, by more than $46 billion.

The cryptocurrency market experienced one of the worst weekly sell-offs in all of 2018, and the prices of major digital assets like Bitcoin have dropped by around 75 percent to 85 percent from their all-time highs.

Despite the steep decline in the valuation of the crypto market, renowned cryptocurrency investor and CoinShares executive Meltem Demirors stated that the cryptocurrency ecosystem, market, and industry are still improving at a rapid rate.

ICOs in Trouble But Industry is Vibrant

Over the past several months, initial coin offering (ICO) projects have lost billions in market cap, after raising more than $30 billion in the past two years. Many projects that have had less than $10 million in daily volume had valuations of hundreds of millions of dollars to billions of dollars, in most cases without any working product to show.

ICOs have started to struggle in remaining relevant and driving new capital into the cryptocurrency market. As Binance CFO Wei Zhou pointed out, it is of significant importance for the long-term trend of the market for the space to see the emergence of high-quality projects and founders to attract smart capital.

“On the issuer side, many crypto projects that raised money through an ICO face massive challenges to stay relevant and create real purpose. This is what happens when you lack a true finance function, and unfortunately, ‘crypto finance’ is still nebulous and undefined on the whole. Just look at this balance sheet below, which characterizes many crypto firms that raised cash through token offerings,” Demirors said.

But, as seen in the success of infrastructure-building businesses like Coinbase and Binance that have achieved a market cap of over $8 billion, the cryptocurrency exchange market and industry have started to see exponential growth in terms of infrastructure, user base, and revenues.

Binance, for instance, achieved 10 million users across 180 countries and in an interview, Binance CFO Wei Zhou emphasized that the company is aiming to secure one billion users in the long run.

As such, while the value of major cryptocurrencies has declined substantially over the past eleven months, Demirors stated that the cryptocurrency ecosystem had grown noticeably in virtually every major area.

“So while value may be moving out of the assets themselves as the market digests new information and re-formulates its thesis on crypto assets, value is continuing to grow across the cohort of companies serving the crypto ecosystem. Just look at the people in this industry — thousands who continue to spend their time, energy, and capital on helping the crypto ecosystem grow. By writing, researching, advocating, building, developing, or simply holding.”

Even Traditional Finance is Struggling

Blackrock, the world’s largest asset manager, recorded its first quarter of net outflows as clients withdrew more than $3.1 billion and analysts are predicting the US stock market to continue sinking after deleting all of 2018 gains.

Bespoke Investment Group co-founder Paul Hickey stated that most investors in the US market are “rushing for the exits,” given current market conditions and intensity of the recent sell-off.

The decline in the momentum of the US stock market, which will directly affect major economies in Asia in the likes of South Korea and Japan, is having a negative impact on the cryptocurrency sector as investors shift away from high-risk, high-return trades.

However, Demirors noted that funds and asset managers in the crypto sector have historically survived several market cycles and major corrections in the past, and 2018 will be no different.

“Lastly, the funds and asset managers in the space, while under pressure, have historically done well given their longer time horizon and their ability to survive and weather market cycles. We expect this trend to continue, especially for some of the larger, better capitalized managers with deep experience who are able to manage finances and allocation strategies to capitalize on short-term price movements while keeping a long-term investment outlook.”

As Binance CEO Changpeng Zhao and Coinbase CTO Balaji Srinivasan said, it is of utmost importance for both businesses and individuals in the space to continue building throughout a mid-term bearish trend.

Images from Shutterstock