The price of copper did not perform well this year, after being amazingly bullish a year ago. What is 2019 going to bring for the price of copper? This article features our copper price forecast for 2019.

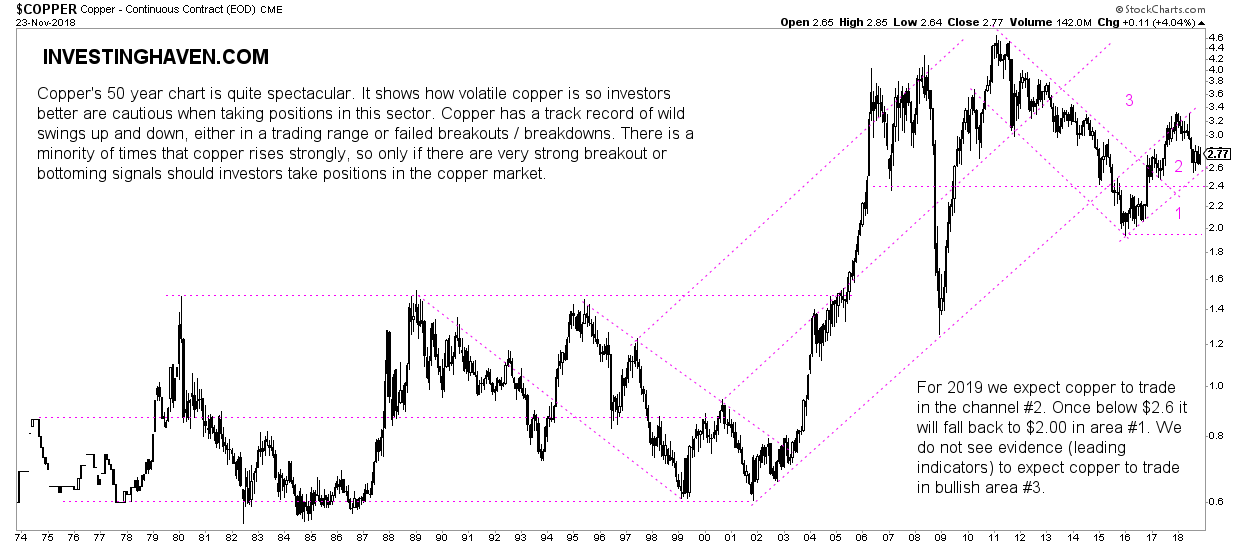

One very important remark before we look into our copper price forecast for 2019: copper is, similar to silver, a restless metal. It does not rise often, but once it starts rising it goes up extremely fast in a very short time period.

We do not want to be invested in the copper market for an extended period of time because the probability of profits is low. That’s why copper is, by far, a market to enter and exit by its chart setups. This is relevant to practically any market in the world, but it applies much more to copper is our point.

Copper Price Forecast for 2019: Supply Forecast

Let’s start by a supply forecast in the physical copper market.

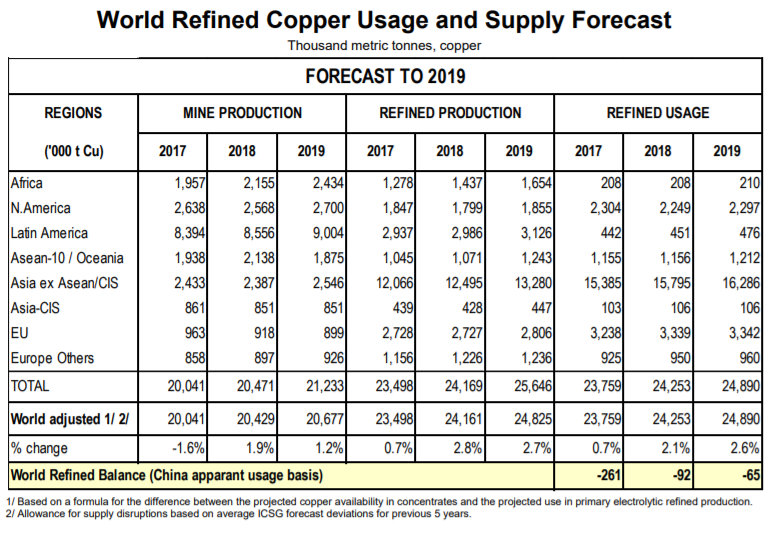

The International Copper Study Group published recently their copper supply forecast for 2019.

After a decline of 1.5% in 2017, world mine production, after adjusting for historical disruption factors, is expected to grow by around 2% in 2018 and 1.2% in 2019:

- World mine production decreased by 1.5% in 2017 due to significant supply disruptions and a lack of significant output from new projects or expansions, but is expected to grow by 2% this year.

- Most of the growth expected in 2018 is due to the recovery from constrained output last year.

- No major supply disruptions have occurred so far in 2018 and most labour negotiations have been agreed. However, overall growth has been negatively affected by lower output at some mines in Canada and operational problems in China, Peru and the United States. As a consequence the ICSG growth forecast for mine production has been revised down to 2% compared with the previous forecast of 2.9% made in April this year.

- Growth in 2019 world mine production, adjusted for disruptions, is predicted to be around 1.2% and is expected to be impacted by a sharp decline in Indonesian output.

This is the table with the detailed supply forecast as well as the aggregates for this year as well as 2019.

The conclusion from the supply forecast: no significant change against this year.

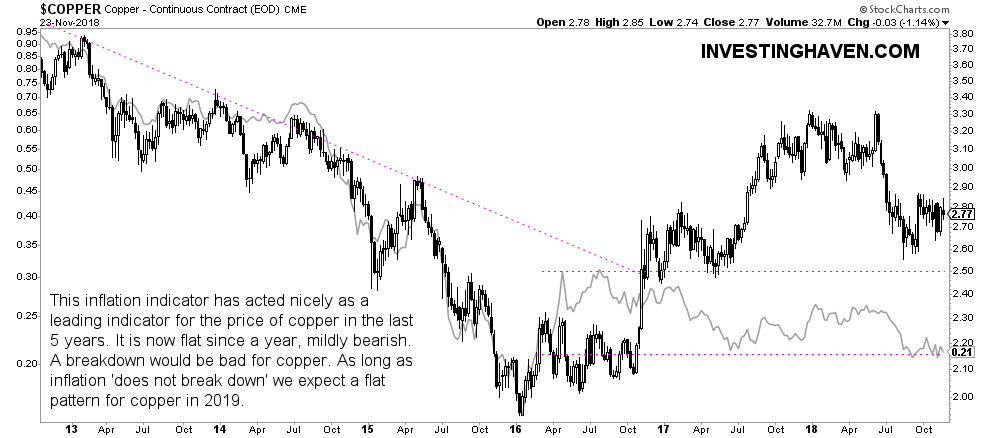

Copper Price Forecast for 2019: Inflation Forecast

The other aspect of copper is its correlation with inflation. Copper might not rise because of supply changes in its physical market but it can certainly move if there is strong inflation.

The proof is on the correlation chart below. Inflation and the copper price have a strong correlation in recent years.

As per our Inflation Forecast for 2019 our inflation indicators all suggest as a base case mildly rising inflation and, potentially, strongly rising inflation. As said:

The key levels to watch for rising inflation: Martin Pring’s inflation indicator above 0.20 suggests ‘inflation is in the air’ while above 0.25 suggests rising inflation, TIP ETF above 106 points suggests ‘inflation is in the air’ while above 112 is a clearly rising inflation trend, AUDUSD above 0.725 suggests ‘inflation is in the air’ while above 0.825 suggests rising inflation.

So our inflation forecast is supportive of slightly rising copper prices. If, and only if, inflation indicators break out will we expect a strongly rising copper price in 2019. We have to carefully watch Marting Pring’s inflation indicator with 0.20 as an important level as well as TIP ETF 112 points and AUDUSD 0.725 as an important level.

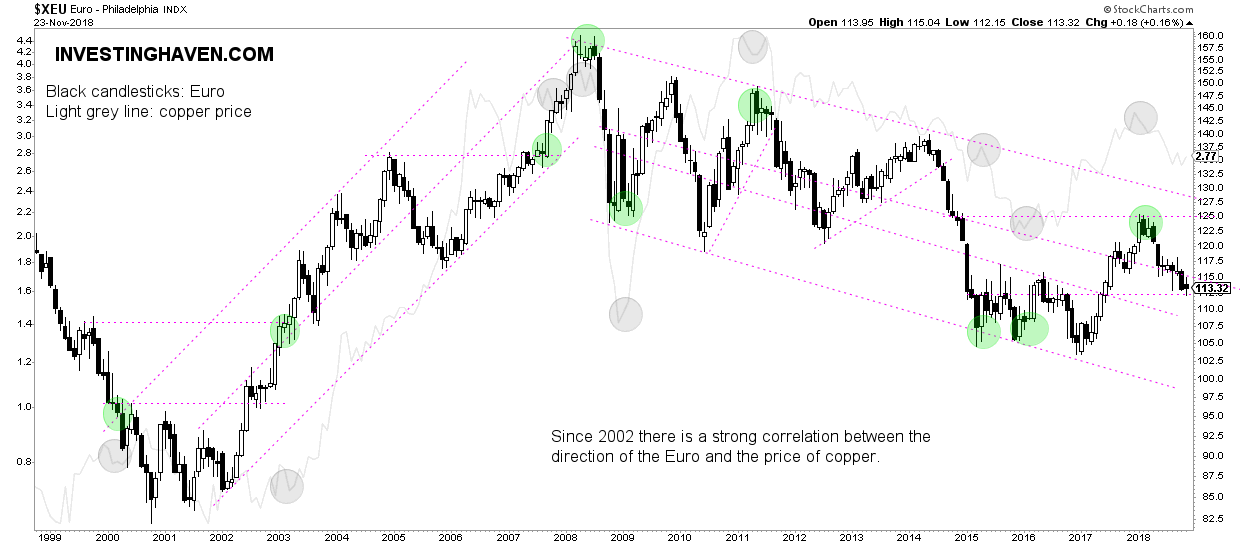

Copper Price Forecast for 2019: Euro forecast

Moroever, the Euro and the copper price are highly correlated especially since 2002.

In other words, much will depend on what happens on the Euro chart. As seen below, the Euro is testing (horizontal) support now. There is double support around the 108-112 level.

A break below this level would be very bearish for the copper price, and also for the whole commodity complex because it is deflationary.

If, and only if, this support level holds strong can we expect support for commodities and copper. In case the Euro rises to its resistance level, say 125 to 127, it will be supportive of copper prices in 2019.

Copper Price Forecast for 2019: Price Target

With the Euro chart sitting near support, inflation looking to rise mildly (at a minimum) and no significant changes in the physical supply in 2019, we have to turn to the copper price chart for additional indications.

We suspect that the copper price will continue to move in its current channel, indicated with (2) on the chart. This would be in line with mild inflation and a Euro that would not break down. In such a scenario our copper price forecast for 2019 is in the range of $2.6 to 3.2.

However, if the Euro breaks down we expect the copper price to fall in area (1) indicated on below chart. Our price target for 2019 would become $2.0 to 2.2.

TOP CRYPTOCURRENCIES TO BUY: Which top crypto tips are flashing a BUY signal now? Which to avoid? Top notch guidance on how to play the grand bull market in crypto from InvestingHaven’s research team, only for $2 per week. Crypto & Blockchain investing service >>