For those who live in the northern hemisphere, winter is coming, while in the cryptosphere it’s already here. In Wednesday’s edition of The Daily, we look at the steps ICOs are taking to preserve their capital as they wait for the markets to warm up again, heralding that winter is over.

Also read: Bitstamp to Deploy New Market Surveillance Tool to Fight Price Manipulation

ICOs Offload ETH and Downsize to Survive

Having belatedly realized that the crypto market may have further to drop, and that staying all in ETH could be fatal, tokenized projects have begun cashing out and cutting costs. Some, such as Aragon, have shown prudence in their treasury management, maximizing capital through smart cryptocurrency acquisition and liquidation. This week, the project sold $1.5 million of cryptocurrency, including $1 million of ETH, and has sought sanctuary from market volatility by taking out a 1 million loan of DAI, Maker’s ETH-collateralized stablecoin.

Having belatedly realized that the crypto market may have further to drop, and that staying all in ETH could be fatal, tokenized projects have begun cashing out and cutting costs. Some, such as Aragon, have shown prudence in their treasury management, maximizing capital through smart cryptocurrency acquisition and liquidation. This week, the project sold $1.5 million of cryptocurrency, including $1 million of ETH, and has sought sanctuary from market volatility by taking out a 1 million loan of DAI, Maker’s ETH-collateralized stablecoin.

Other tokenized projects have not been so fortunate or astute at balancing their budgets however. In addition to Aragon, over 100,000 in ETH has been sold by ICOs in the past week in a belated attempt to stem diminishing funds. A number of projects have also begun to lay off staff, including Steemit, which is shedding 70 percent of its workforce. In a blog post, Steemit CEO Ned Scott attributed the move to “the weakness of the cryptocurrency market, the fiat returns on our automated selling of STEEM diminishing, and the growing costs of running full Steem nodes.” He added:

I would like to thank all of our employees and contractors for their months and years of dedication and hard work. It is incredibly difficult to part with these great people who I have gotten to know well and respect.

Stably Announces Meta Stablecoin

Stablecoins, representing the promise to pay the bearer a corresponding asset that promises to pay the bearer an agreed amount, are already very meta. Stably’s forthcoming dollar-pegged coin takes this metaness to a new level though. Its new stablecoin will use a basket of stablecoins as its reserve, including its own stableusd (USDS) as well as potential candidates such as USDC, TUSD, GUSD and DAI.

Stablecoins, representing the promise to pay the bearer a corresponding asset that promises to pay the bearer an agreed amount, are already very meta. Stably’s forthcoming dollar-pegged coin takes this metaness to a new level though. Its new stablecoin will use a basket of stablecoins as its reserve, including its own stableusd (USDS) as well as potential candidates such as USDC, TUSD, GUSD and DAI.

“Our approach to building this basket will be to design a coin with institutional cryptocurrency traders in mind,” explained Stably. “The main advantage of this coin will be diversification of counterparty risk. A user can confidently trade this coin knowing that the risk profile of the coin is diversified with several other stablecoin projects.”

Whether investors are swayed by this argument remains to be seen. In the U.K., meanwhile, London Block Exchange (LBX) and Alphapoint have launched GBPP, the first stablecoin pegged to the pound sterling (GBP).

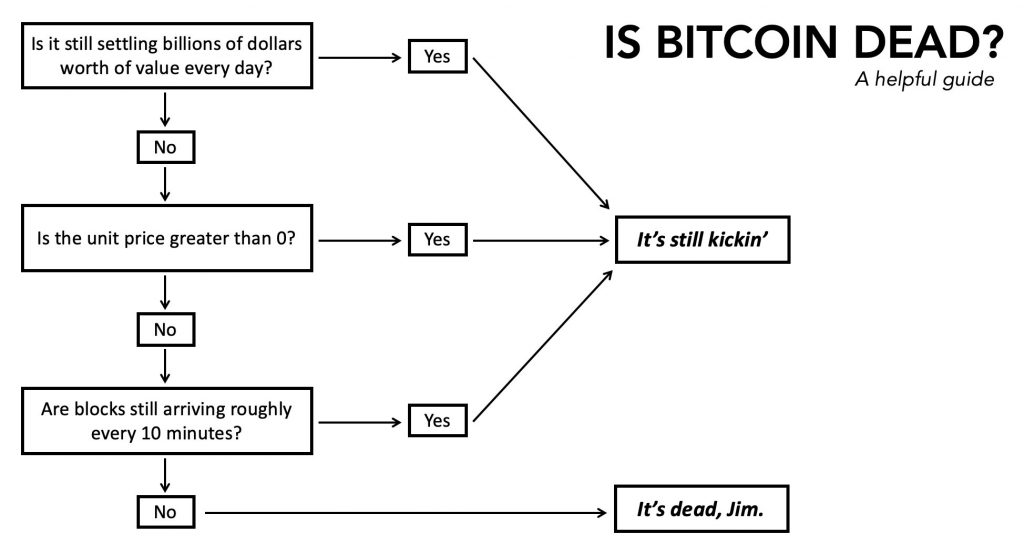

Bitcoin’s Not Dead and Here’s the Proof

Finally, while cryptocurrency users need no convincing that there’s a lot of life in bitcoin yet, mainstream media aren’t so sure. For years, bitcoiners have directed crypto coroners in the direction of the obituary page that records the number of times BTC has been declared dead. Nic Carter has now assembled a handy flowchart to help set the record straight any time the media declare, for the umpteenth time, that bitcoin is dead.

What are your thoughts on today’s news tidbits as featured in The Daily? Let us know in the comments section below.

Images courtesy of Shutterstock and Twitter

Need to calculate your bitcoin holdings? Check our tools section.