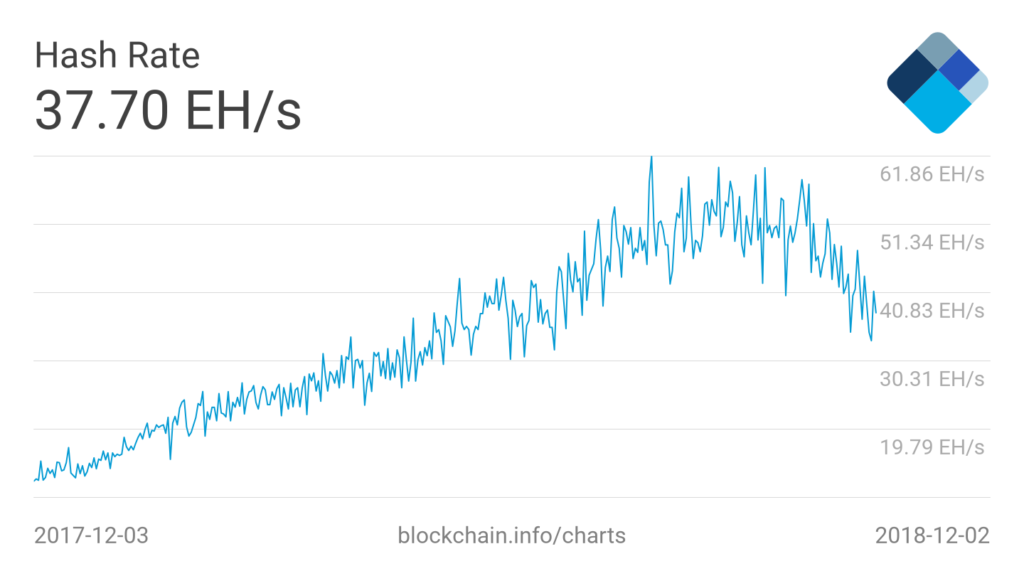

The crypto market’s prolonged decline has finally begun to manifest in the bitcoin mining industry, which had at times seemed impervious to falling prices but is now experiencing a moderate exodus.

Bitcoin Hash Rate Begins Rare Decline

At a basic level, miners produce Bitcoin blocks by competing to solve complex mathematical problems. When the hash rate increases, blocks are found more quickly, while the converse occurs when the hash rate declines. To maintain a consistent block time of ~10 minutes, Bitcoin automatically adjusts the difficulty of these problems at roughly two-week intervals to account for new machines entering or exiting the network.

For years, the difficulty has almost exclusively increased, as a general price uptrend coupled with rapid advancements in mining technology has resulted in sustained hash rate growth, even during periods of negative market trajectory. However, nearly one year into a bear market that has seen the bitcoin price fall more than $16,000 from its all-time high, that is no longer true.

As CCN reported, the Bitcoin hash rate has been in decline since mid-October, as falling prices hastened the rate at which older miner models became obsolete and profit-driven firms at the margins began to turn off their machines to avoid operating at a loss. One estimate pegs the average cost of producing a new unit of BTC at $4,500, a mark BTC has generally traded below since Nov. 20, though the hash rate began to decline about one month prior.

The 275th Bitcoin mining period has started with block 552,384. ⛏ New difficulty: 5,646,403,851,534 (-15.13%)

— Bitcoin Block Bot (@BtcBlockBot) December 3, 2018

This miner exodus is now being reflected in Bitcoin’s network difficulty, which fell by more than 15 percent following the regular difficulty adjustment that occurred earlier today. According to data compiled by XDEX Chief Analyst Fernando Ulrich, this constitutes the second-largest difficulty drop in Bitcoin’s decade-long history and the largest since Nov. 1, 2011, when the difficulty dropped by 18 percent.

#Bitcoin just had its second largest drop in mining difficulty in history: -15.1%. This is the current ranking:

2011-nov-01: -18.0%

2018-dec-03: -15.1%

2011-oct-16: -13.1%

2012-dec-27: -11.6%

2011-mar-26: -9,5%

2013-jan-26: -8.6%

2011-dec-01: -8.5%

2012-may-25: -9.2%— Fernando Ulrich (@fernandoulrich) December 3, 2018

Today’s difficulty adjustment marked the second-consecutive decrease, with the difficulty dropping by 7.3 percent on Nov. 18. That decline was notable in its own right, as it marked the largest decrease in around six years and currently ranks as the 10th-largest drop overall.

Prior to Nov. 18, the last time the difficulty decreased was on July 15, and such decreases have been a rare occurrence over the past several years. At a present value of 37.7 EH/s, the BTC hash rate is down 39 percent from the single-day high of 61.9 EH/s it set in late August. It is also down approximately 31 percent from the weekly average peak it set on Oct. 1.

The Beginning of a ‘Death Spiral’ or a Healthy Development?

Bitcoin bears such as Santa Clara University Professor of Finance Atulya Sarin allege that this recent decline indicates that the market has entered a “death spiral,” since — so the argument goes — BTC derives its value from the cost of mining.

However, eToro Senior Market Analyst Mati Greenspan said recently that the recent hash rate decline is a healthy market development, given the parabolic rate at which it grew over the previous 12 months — even as prices plunged.

“Bitcoin’s hash rate has indeed dropped in the last few weeks but this is not at all concerning,” Greenspan said at the time. “It’s actually comforting as the rate has risen so sharply over the course of the year and is now returning to normalized levels.”

Featured Image from Shutterstock

Get Exclusive Crypto Analysis by Professional Traders and Investors on Hacked.com. Sign up now and get the first month for free. Click here.