The crypto bear market is showing little signs of letting up. On Tuesday, a fresh wave of selling engulfed bitcoin and altcoins, dragging the market toward fresh yearly lows and thrusting Tether (USDT) in to the top-five by market cap. Against this backdrop, it’s easy to forget that cryptocurrencies like bitcoin have become so resilient to death that no amount of fear, uncertainty and doubt can override the phenomenon currently underway.

Market Update

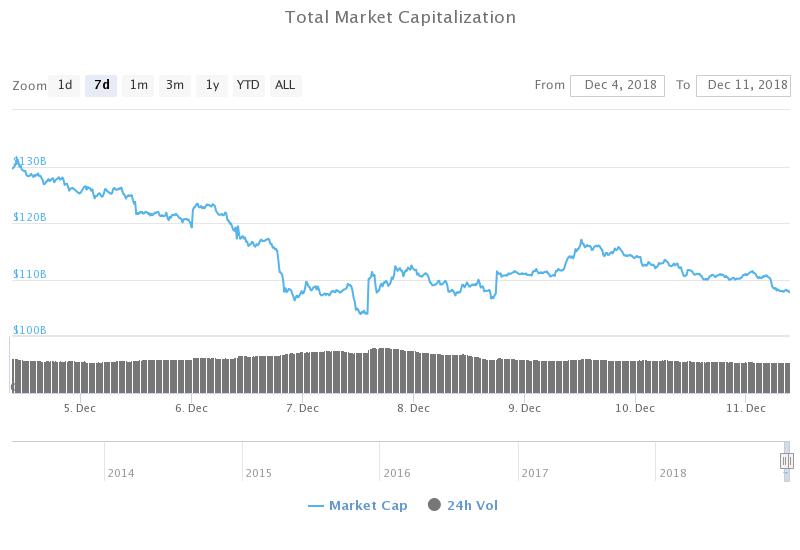

The market capitalization of all cryptocurrencies reached a low of $107.3 billion on Tuesday, as bearish forces continued to push prices lower. Last week, the market bottomed around $103 billion, marking a new 15-month low. The way prices are going today, new lows are likely in the short run.

Losses among the majors ranged from 2% to 8%, with bitcoin reaching the lower end of $3,300. The leading digital currency is quickly approaching a critical test of the $2,800-$3,200 support following a series of lower lows and lower highs.

The widespread selloff has allowed Tether to reclaim its stablecoin status. USDT was last valued at $1.01, where it was trading slightly higher than its dollar-peg would suggest. Tether is now a $1.9 billion market, ahead of bitcoin cash, EOS and Litecoin.

Bitcoin Life Expectancy

The crypto market cap is by no means a perfect measure of overall health but provides a fairly accurate snapshot of where digital assets are trending. The extent to which bitcoin dominates the overall market capitalization is also telling. As of Tuesday, the leading digital currency represented 55% of the total market and has risen steadily amid the latest correction.

Bitcoin continues to exert a strong gravitational pull on the rest of the market, which analysts say is a reflection of the nascent state of digital currencies as a whole. During the height of the bull rally in January, bitcoin’s share of the total market fell to around 32%. This broad “decoupling” of bitcoin and other virtual currencies was considered a sign of market maturation. Eleven months later, talk of “market maturation” has all but dissipated as investors continue to gauge just how far prices will fall.

Media and traditional financiers have framed the recent price collapse as crypto’s biggest existential crisis. To them, there is no sign of a bottom until prices reach zero.

This may be the case for a myriad of the 2,000+ cryptocurrencies in circulation but does not represent the fate of projects that have developed real products. In the case of bitcoin, historical precedent suggests that a fall to zero simply isn’t in the cards. Bitcoin has collapsed longer and harder in the past, only to re-emerge stronger and more resilient than ever before. Its chance of survival continues to grow each time it overcomes attack, hard forks and FUD. This feeds directly into the Lindy Effect, which states that the remaining life expectancy of any system grows for every additional period of survival.

Bitcoin and other leading cryptocurrencies are a monetary phenomenon that have generated waves of adoption in circles that matter most: banks, businesses, global payment providers. And although people have tried to parse out “bitcoin” from “blockchain,” the value of cryptocurrency technology has rendered this distinction more difficult to analyze in a practical sense (as the CEO of Lighting Labs put it, we are entering a “bitcoin, not blockchain” world).

For the past decade, bitcoin has run on almost zero financial loss on the chain itself, making it the most reliable financial network in the world. Bitcoin is so decentralized, in fact, that the U.S. Securities and Exchange Commission (SEC) has officially declared that it cannot be considered a security. As investors will soon find out, autonomous networks that are sufficiently decentralized and with no central authority are difficult to kill.

This is by no means a “forecast” of where things go from here. Clearly, crypto is in a profound bear market that will yield additional pain and destruction for a large share of existing blockchains. But don’t let anyone fool you into believing that this this spells the end of bitcoin. It’s only the beginning.

We’ll leave you with the following quote from Nassim Nicholas Taleb to consider:

“… Bitcoin is an excellent idea. It fulfills the needs of the complex system, not because it is a cryptocurrency, but precisely because it has no owner, no authority that can decide on its fate. It is owned by the crowd, its users. And it has now a track record of several years, enough for it to be an animal in its own right.”

Disclaimer: The author owns bitcoin, Ethereum and other cryptocurrencies. He holds investment positions in the coins, but does not engage in short-term or day-trading.

Featured image courtesy of Shutterstock.