The city of Zug, home of the Swiss Crypto Valley, has been named the fastest growing technology community in Europe. Zug ranked atop the “State of European Tech” report by London-based global investment firm Atomico last week, on the strength of its year-on-year growth of attendees to tech-related meetup events.

Also read: Malaysian Financial Regulators to Intensify Scrutiny of ICOs, Cryptocurrencies

Zug Tech Ecosystem Grows

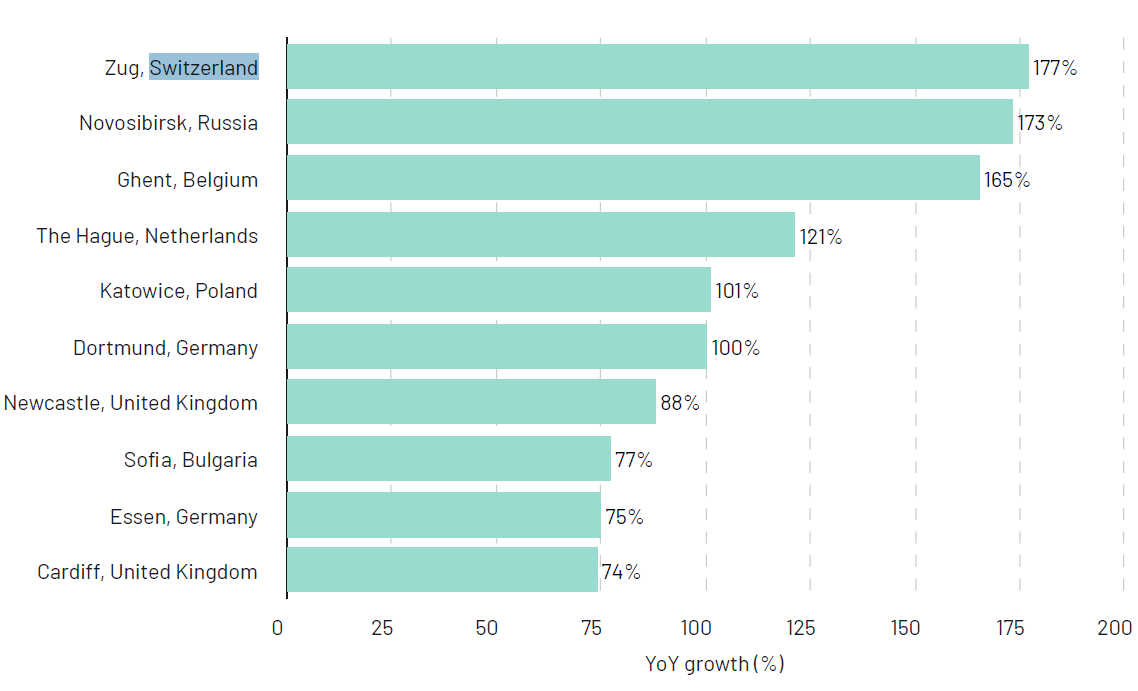

According to the report, Zug recorded a 177 percent increase in the number of tech meetups in 2018, compared to last year. The city’s crypto activity has been warmly supported by the Swiss government, which is fine-tuning its legislation and policies to improve financial innovation, with particular emphasis on virtual currencies.

“There is a huge geographic diversity among the top 20 fastest-growing tech hubs in Europe, as measured by the annual growth in attendees to tech-related meetup events in those cities. Zug in Switzerland, home to a growing crypto community, ranked number one as the fastest-growing community overall,” the report said.

Novosibirsk in Russia follows Zug with 173 percent increase in tech meetups, while Ghent (Belgium), The Hague (Netherlands) and Katowice (Poland) complete the top 5 of the fastest-growing tech communities.

Novosibirsk has reported startup activity in its science and technology hub, Akademgorodok, also known as the Siberian Silicon Valley. Success stories out of the suburb include nanotechnology firm Ocsial, precision laser manufacturer Tekhnoscan and banking software company CFT.

The Atomico report emphasized community-building, measured by the meetups of technological talent, as necessary for attracting investment to cities. This year, the density of meetups in Europe equated around 200 events per day throughout the year.

Progressive Switzerland

Switzerland has taken a progressive stance towards cryptocurrency, legalizing its use and formalizing crypto transactions in a range of contexts. The country sees virtual money and blockchain technology as strategic innovations in global finance and is intent on maintaining the growth of the industry, while expanding the number of jobs it has to offer in the field.

The city of Zug has led this growth. According to a report by CV Venture Capital in October, the top 50 cryptocurrency and blockchain-related companies in Switzerland’s version of the Silicon Valley are now worth $44 billion combined, underscoring the steady growth of the Swiss crypto industry.

The report shows that the number of companies working either with digital coins or blockchain technologies in Zug has almost doubled to 600 in the past year. About 350 entities were featured in the directory when the CV Maps database was first launched in April of 2017.

Of the top 50 companies listed, five are unicorns that are either based in the Crypto Valley or originated from the area. They include the world’s biggest bitcoin miner, Bitmain, as well as other leading cryptocurrency organizations such as Cardano, Dfinity, Ethereum and Xapo, CV said. Bitmain’s revenue soared 1,700 percent to $2.5 billion in 2017, from just $137 million two years earlier. Its full-year net profit rocketed to $1.2 billion.

Lagging Behind

According to the Atomico study, Switzerland’s Zürcher Kantonalbank is the second most active corporate investor in Europe, after being involved in 20 financing rounds in the last 12 months. In terms of tech destinations, however, the country fell behind its European counterparts at the tenth position, while the U.K., Germany and France led the pack. Switzerland also failed to make the list of 12 destinations for U.S. software engineers looking for jobs in Europe.

Swiss state enterprises are making power moves as far as cryptocurrency is concerned. The country’s postal service, Swiss Post, and telecom provider Swisscom, both state-run, recently announced that they are collaborating on a “100 percent Swiss” blockchain infrastructure, with a view of meeting the security requirements of banks and retaining all data within Switzerland. The country was named the most “blockchain-friendly” European country earlier this year.

Apart from Switzerland, major economies, most recently the U.S., higher learning institutions and legacy financial institutions have been taking a second look at their look books and policy frameworks to keep up with crypto disruption. Areas of concern have included security and issues of access.

What do you think about the Atomico rankings? Let us know in the comments section below.

Images courtesy of Shutterstock.

Need to calculate your bitcoin holdings? Check our tools section.