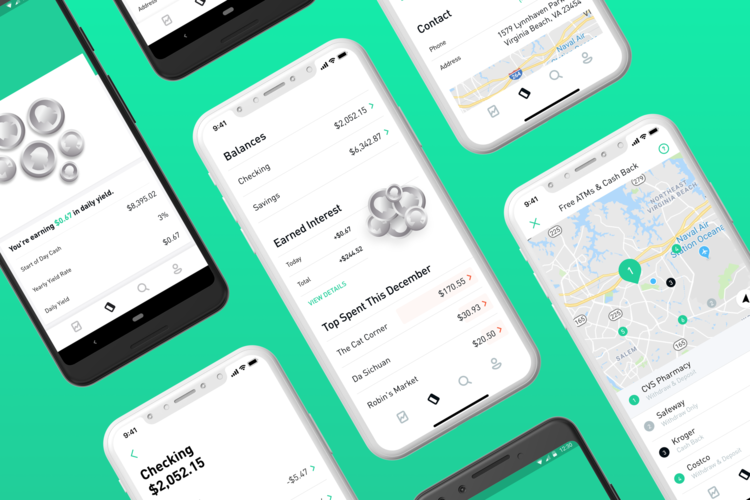

Menlo Park-based Robinhood has launched savings and checking accounts for its US customers, according to a company blog post. The new accounts would follow the similar trend that we have become accustomed to: “fee-free, commitment-free and surprise-free” were the words used lavishly on the company’s website. Robinhood, which operates a crypto trading platform in addition to its flagship stock trading service, is also disrupting what customers can expect to earn on their bank deposits. The startup promises to pay 3 percent interest for every deposit made in both checking and savings accounts.

“Currently, traditional checking and savings accounts cost more for people who make less, are riddled with unfair and hidden fees, and earn you minimal returns on your savings. We believe you should earn more on your money, and shouldn’t be charged fees to access it,” the company’s blog reads.

As far back as June, the crypto-friendly Robinhood was rumored to be making moves to offer banking services to its user base, which has swelled to more than 6 million accounts. Bloomberg had quoted anonymous sources who said the startup was in advanced discussions with the US Office of the Comptroller of the Currency (OCC) so it could become a banking service provider. While the firm has yet to receive permission to operate as a bank, it said that it had structured its checking and savings accounts such that they could be offered under its current licenses.

The account also comes with a personalized debit card, which Robinhood claims can be used in over 75,000 ATMs across the US for free cash withdrawals. For users who are unsure where the free ATMs are located, the Robinhood app would have a new feature that allows you to find the nearest ATM.

But while Robinhood does not have a bank charter yet, it does have a broker-dealer license and is a member of the Securities Investor Protection Corporation, allowing it to protect cash accounts up to $250,000. Not having the bank charter also limits the kind of investments it can buy up with the deposits. For now, the startup would be generating funds from investments in safe assets like US Treasury bonds and interchange fees from debit card transactions.

As Robinhood continues to disrupt the financial sector in the US, European digital banking alternative Revolut — which also offers crypto trading — has its sights firmly on conquering Europe. The London-based startup recently received the green light to offer European customers banking services. As reported by CCN, Nikolay Storonsky, founder and CEO of Revolut noted:

“Our vision is simple: one app with tens of millions of users, where you can manage every aspect of your financial life with the best value and technology.”

Featured Image from Shutterstock

Get Exclusive Crypto Analysis by Professional Traders and Investors on Hacked.com. Sign up now and get the first month for free. Click here.