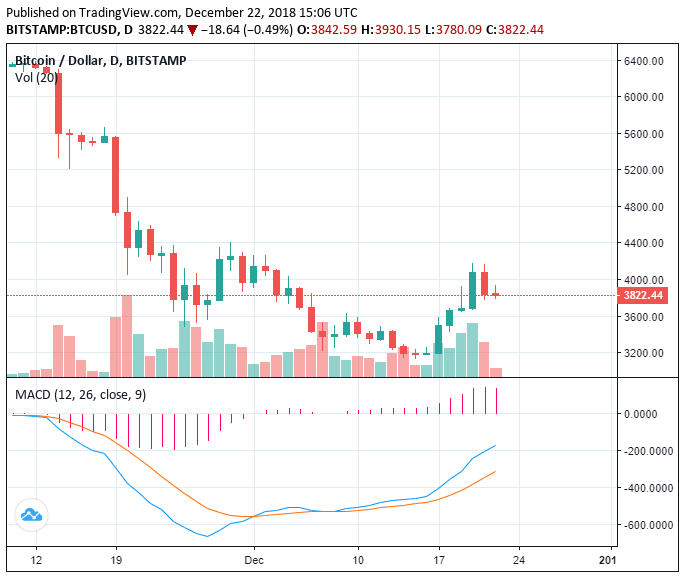

In the past 24 hours, the crypto market recorded a loss of over $7 billion as its valuation dropped from $134 billion to $127 billion. The Bitcoin price declined below the $4,000 mark after surging to $4,100, struggling to maintain its newly found momentum.

As the Bitcoin price dropped from $4,162 to $3,780 and demonstrated a 9 percent decline in value, most major crypto assets in the likes of Ripple (XRP) and Bitcoin Cash (BCH) recorded larger drops in the range of 15 to 25 percent.

From its weekly peak, the Bitcoin Cash price fell from $239 to $180, by just over 24 percent. A minor correction was expected for the majority of assets in the global crypto market due to the large gains they recorded throughout the past week.

Where is Bitcoin Heading?

Last week, when Bitcoin achieved a new yearly low at $3,100, a strong buy wall was created on major fiat-to-cryptocurrency exchanges Coinbase and Bitstamp. Existing investors saw a buying opportunity in the tight range from $3,000 to $3,500.

As the high buy wall started to accumulate the dominant cryptocurrency, Bitcoin experienced a corrective rally and fueled other crypto assets in the market to increase in price.

Bitcoin Cash, in particular, showed a strong upward movement, tripling its value from $75 to $239 within a five-day span.

A technical analyst with the online alias “Hsaka” explained that the $3,910 mark was tested as a resistance level and the failure to overcome it led the price of Bitcoin to drop below the $3,800.

The analyst wrote:

“Expecting a bounce into a lower high off this white level. If $3,910 is retested as resistance, high odds that was the local top and we’ll begin unraveling soon. If this is heading down soon, I’d ideally want to see it reject off the $3,890 level. Otherwise, might just chop around on the weekend and break down on Monday.”

The volume of Bitcoin has also substantially declined from around $8 billion to $5.9 billion. The decline in the volume of the asset was expected as the cryptocurrency market tends to see a drop in trading activity during the weekend.

Expect Less Trading Activity and Price Action

As the Christmas season nears, the cryptocurrency market is likely to see its volume drop, which could lead to less intense buy walls but also relieve sell pressure on major assets.

On December 20, a cryptocurrency trader known as DonAlt said that the bear market is not over just yet and that it is not the time to start accumulating, adding that the market is merely showing volatility in a low price range.

“By the way, this is not the place to start buying. A full year bear market doesn’t just go away like this, it’ll take time. Even if BTC goes to $4,270 I’ll only be looking to short/close longs. We’re still in a bear market, BTC is just rightfully punishing late bears,” the trader said.

Featured Image from Shutterstock. Charts from TradingView.

Get Exclusive Crypto Analysis by Professional Traders and Investors on Hacked.com. Sign up now and get the first month for free. Click here.