According to new research from the Wall Street Journal, more than 15% of crypto projects raising funds through initial coin offerings (ICOs) have serious red flags that should give investors pause. The investigation, which analyzed the whitepapers of 3,300 cryptocurrency offerings and ICOs launched in 2017 and 2018, found that 513 of them likely committed plagiarism, misrepresented the identities of project founders, or promised unrealistic returns.

Significant Number of Crypto Projects are Highly Questionable

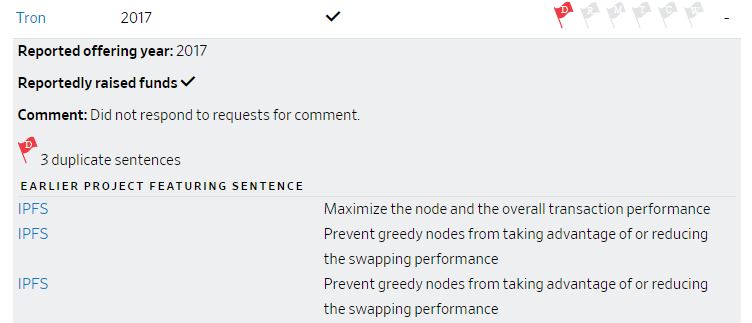

The Wall Street Journal examined the white papers of all 3,300 projects which it found listed on ICOBench.com, Tokendata.io, and ICORating.com. To identify plagiarism, the reporters compared sentences in all the reports to find duplication, with reporters identifying over 10,000 sentences that appeared more than once. The papers were also searched to identify offerings where no team members were provided, and the publication reverse image searched photos to identify fake team listings. Lacking or fraudulent team, founder, or sponsor details have long been a red flag for illicit crypto projects and should be one of the first details an investor scrutinizes for accuracy.

To find “improbable” promises of returns the whitepapers were keyword searched for critical marketing terms like “high return” and then analyzed manually before reporters decided they were an unrealistic “can’t miss” opportunity.

Of the 513, over 30 are already under scrutiny by regulators, and over half of the project websites are unavailable. Each of the over 250 unavailable websites was pinged electronically and also checked manually.

Reporters reached out to all 513 flagged offerings for comment on the findings. Very few could be reached or chose to respond.

Unsurprising Results?

The Wall Street Journal results are hardly surprising given other recent reports on the ICO market and the intense regulatory scrutiny, and increasing measures, against offerings. It’s true that many ICOs have failed, many companies took advantage of a new funding model to launch less than credible projects and, many other projects have been judged scams.

Forrester Research recently found that most ICOs have struggled to produce viable projects or adequately prepare for a cryptocurrency bear market.

The US Securities and Exchange Commission (SEC) has been conducting an ever-increasing program of clampdowns on ICOs. In May, US and Canadian regulators launched “Operation Crypto Sweep” after concluding that fraud was widespread.

More recently the SEC has called for international support in continuing its enforcement as many ICO sponsors are located outside of the US but offer investment opportunities within the country. The global nature of cryptocurrencies is causing a similar problem in other regions. For the SEC, other recent measures including hitting celebrities who promoted ICO scams with fines and other enforcement actions.

Change Ahead for 2019?

That said, there are many very real projects to have been funded through an ICO mechanism, take the SIRIN Labs Finney and Brave Browser — both of which have produced working products — as examples. On the flip side, fraudsters take advantage of all trendy investment classes, not just cryptocurrency.

SEC chairman Jay Clayton has received criticism in recent weeks that his harsh approach is restricting innovation. There is hope that balance can be found in 2019, that credible projects will continue to innovate, and that the growing scrutiny on fraudulent offerings will begin to deter them.

With increased attention from regulators, crypto startups are already moving away from ICOs, seeking funding instead via more traditional routes of private and venture capital funding. Others are looking to a new model, the security token offering (STO), seeking to bring themselves into compliance rather than eschew it.

Featured Image from Shutterstock

Get Exclusive Crypto Analysis by Professional Traders and Investors on Hacked.com. Sign up now and get the first month for free. Click here.