Most cryptocurrencies took a hit on Christmas Day, losing between 5-10% after having a decent run of solid gains last week. Some traders had assumed digital asset markets would be rather dull during the holidays, but the correction was deep and fast. At the moment, the entire cryptocurrency economy is worth $126 billion as traders are curiously waiting for the next big move.

Also read: Year in Review: 2018’s Top Cryptocurrency Stories

Crypto Markets Show It’s Too Soon to Call the Bottom

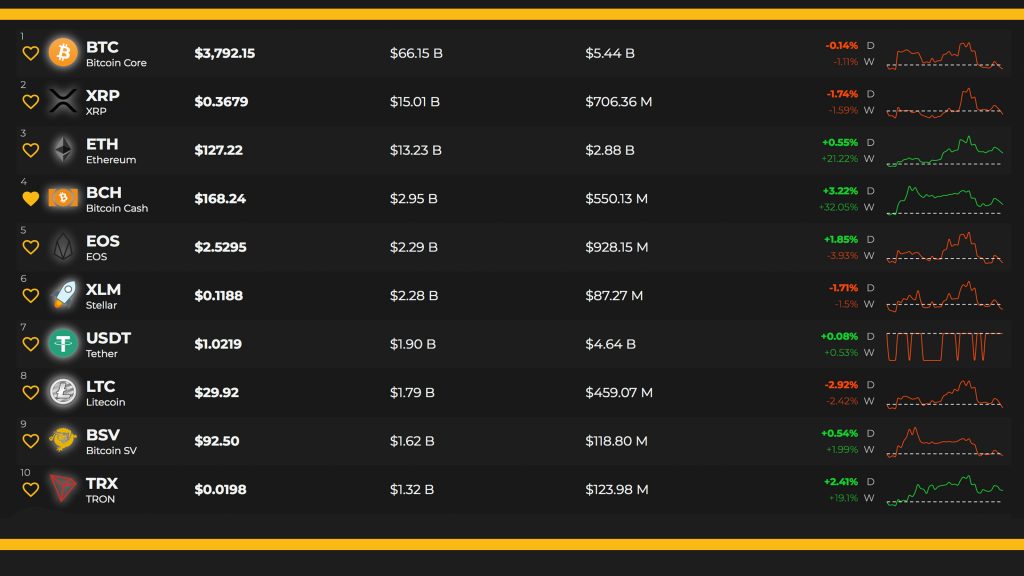

Cryptocurrency markets have consolidated a little after taking some deep losses during the early morning hours of Dec. 25. Global trade volume for the entire ecosystem of digital assets had dropped a few billion since last week’s price spikes, and bulls are starting to show signs of exhaustion. This Wednesday, the combined valuation of all 2,000+ cryptocurrencies in terms of 24-hour trade volume is roughly $17.4 billion. Bitcoin core (BTC) is trading for $3,792 at the time of publication and its markets are capturing $5.4 billion worth of today’s crypto trades. BTC is down 0.14% over the last 24 hours and down 1% for the week. The second largest market capitalization is commanded by ripple (XRP) which is trading for $0.36 per coin. Ripple markets are down 1.7% over the last day and are down 1.5% for the week.

Ethereum (ETH) has had a much better run over the last few days, with ETH markets up 0.55% today and 21% during the course of the last seven days. ETH is trading for $127 per coin and has a total market capitalization of around $13.2 billion. Lastly, the fifth biggest market valuation is still held by eos (EOS), where each token is swapping for $2.52. EOS has a $2.2 billion market cap and is up 1.8% today but down 3.9% for the week.

Bitcoin Cash Market Action

Bitcoin cash (BCH) markets are still doing very well this week after last week’s phenomenal 140% gains. BCH is still up by 32% over the last seven days and markets are up 3.2% in the last 24 hours. At the moment, BCH is trading for $168 per coin and the market has an overall valuation of about $2.9 billion. Trade volume is about $100 million lighter than a few days ago as today’s global BCH trade volume is around $551 million.

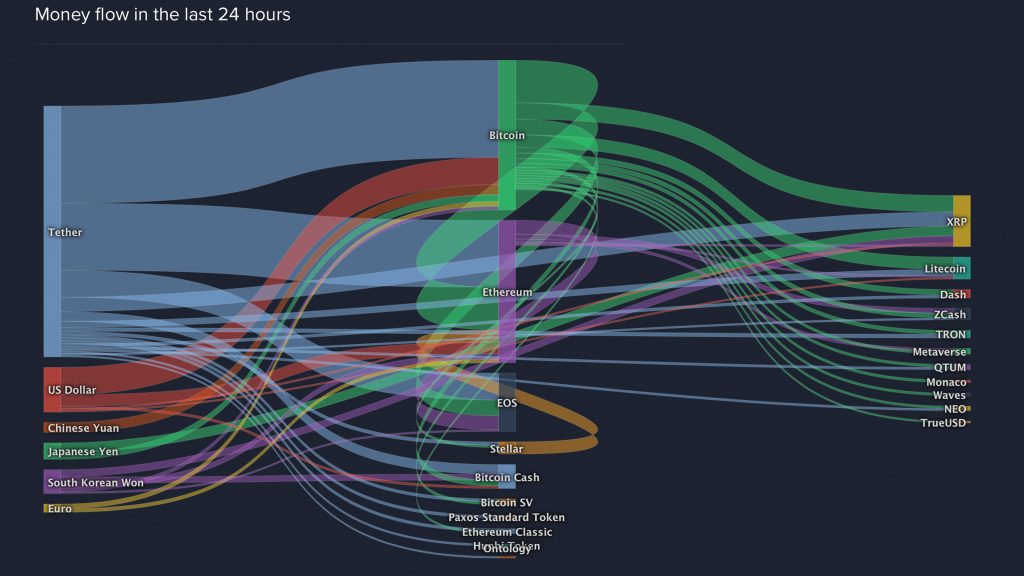

The top five exchanges swapping the most bitcoin cash are Lbank, Binance, Huobi, Coinbase, and Hitbtc. Lbank and Binance are capturing about ⅓ of today’s BCH trades. The top currency today paired against BCH is tether (USDT), with 47.3% of trades. This is followed by BTC (20.9%), ETH (16%), USD (7.4%), JPY (3.9%), and the KRW (1.9%). Bitcoin cash is the sixth most traded cryptocurrency on Wednesday above litecoin but below the volume of ripple.

BCH/USD Technical Indicators

Even though there was a sizeable dip the other day, a few indicators on the charts still look bullish. Looking at the four-hour BCH/USD chart on Bitstamp shows the two Simple Moving Averages will be crossing hairs very soon as the 100 SMA may rise above the longer term 200 SMA. For now, the path toward the least resistance is still the downside, but in the near term it looks like a trend change may appear.

Right now the Relative Strength Index (RSI 4-H -44.96) is meandering in the middle, indicating more uncertainty. The Holidays may be inflicting a slight lull as the stochastic reports the same findings over a broad set of trading ranges. Looking at the order books shows bulls need to muster up more strength to penetrate the $200 region again and gain headway. On the backside, bears will see pit stops all the way until the $150 range and a few more speed bumps if it falls below that price zone.

The Verdict: Uncertainty Remains Strong

This week has seen traders perusing ideas on Tradingview, some discussions between swing traders on Twitter, and Telegram trading channels showing people think the “bottom” has not yet been reached. The dip in trade volume was to be expected over the holidays between Christmas and New Year and analyzing crypto market trade volume may not be a great source of confirmation this week.

BTC/USD and ETH/USD shorts are still well above normal, but discernibly less than two weeks ago. If digital asset markets cannot hold above the 50-day exponential moving average (EMA) then traders may see even lower bottoms in the near future. Overall, uncertainty remains high for traders who won’t attempt to call the bottom. Their stance is prudent one given that price letdowns have been one of the few certainties throughout the entire year.

Where do you see the price of BCH, BTC and other coins heading from here? Let us know in the comments below.

Disclaimer: Price articles and markets updates are intended for informational purposes only and should not to be considered as trading advice. Neither Bitcoin.com nor the author is responsible for any losses or gains, as the ultimate decision to conduct a trade is made by the reader. Always remember that only those in possession of the private keys are in control of the “money.”

Images via Shutterstock, Trading View, Coinlib.io, Bitstamp, and Satoshi Pulse.

Want to create your own secure cold storage paper wallet? Check our tools section.