Hundreds of businesses and retail investors are still counting the cost of bitcoin’s 80 percent drop from its all time high at the turn of the year. A Sky News special report has revealed that alongside investment portfolios, bitcoin’s price tank also claimed several mortgages, loans, marriages and even possibly university funds for some investors’ children in some cases.

While the damage wreaked by bitcoin’s price crash on Asian and American investors is well documented, the new report provides an insight for the first time into the extent of damage suffered by UK retail investors who began investing increasingly substantial amounts of money in bitcoin around the middle of 2017, culminating in the feeding frenzy that led bitcoin to the cusp of $20,000 before its sudden and sustained drawdown.

British Opportunists Get ‘Rekt’

According to the report,the typical bitcoin investment story by the affected UK buyers was not anchored in realistic or well thought-out strategies, but was generally driven by a fear of missing out as bitcoin skyrocketed in just a few months from being worth a little of $1,000 to more than $10,000. While some recognised the short-termist nature of their strategy and hoped to sell at a tidy profit before a crash, many went in with a hazily-defined set of expectations that essentially boiled down to getting rich very quickly while doing very little work at all.

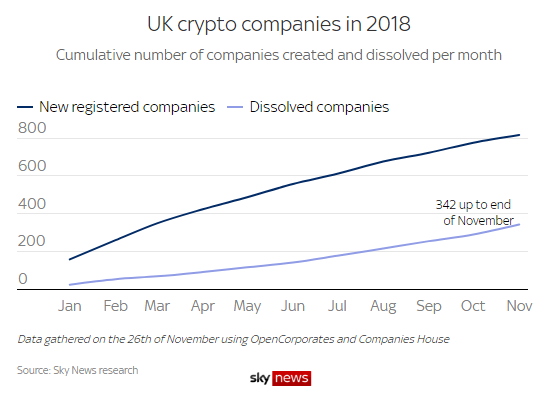

Nowhere was this illustrated more starkly than in the registration of new companies purportedly involved in the blockchain ecosystem. According to the UK Companies House records, at least 340 such companies were liquidated or dissolved in 2018, compared to 139 in 2017. Of this number, over 200 were only registered in 2017, meaning that 58 percent of the blockchain related companies registered in the UK at the height of bitcoin mania did not survive the crash.

Speaking to Sky News about the situation on the ground during the period, cryptocurrency and blockchain entrepreneur Hugh Halford-Thompson said:

There was a lot of people getting in, and I think for the first time I felt there were a large number of people who really didn’t understand what they were getting into as well. So every Uber driver I had either had invested or was thinking about it. I had people asking me genuinely which coin to put their children’s university funds into. That’s not good. I didn’t follow up with them, but I hope they didn’t. For the first time a lot of normal people who didn’t understand investments [were getting involved, and they]made or lost money in fairly big ways. It’s a lot worse when it’s the general public.

The mania came to a predictable and well documented end at the turn of the year as bitcoin suddenly began shedding vast amounts of value, halving by March and eventually threatening to break $3,000 by early December after a year spent largely hovering between $5,000 and $7,000. By June, an average of one blockchain related company was being dissolved daily, with 60 percent of the 340 dissolved companies going out of business in the second half of the year.

As a result, for the first time, the number of such companies being dissolved is growing faster than the number being registered.

Perhaps most tragic are the stories of individual retail investors who remortgaged their homes or took out personal loans to invest in bitcoin – sometimes without even consulting their families or spouses – leading to destroyed personal finances and broken relationships following the crash.

In true opportunist fashion however, many businesses that were set up to take advantage of bitcoin mania have morphed into new iterations. According to Sky News, at least 50 of the companies which avoided dissolution have now changed their names to omit all reference to cryptocurrencies or blockchain technology.

Get Exclusive Crypto Analysis by Professional Traders and Investors on Hacked.com. Sign up now and get the first month for free. Click here.