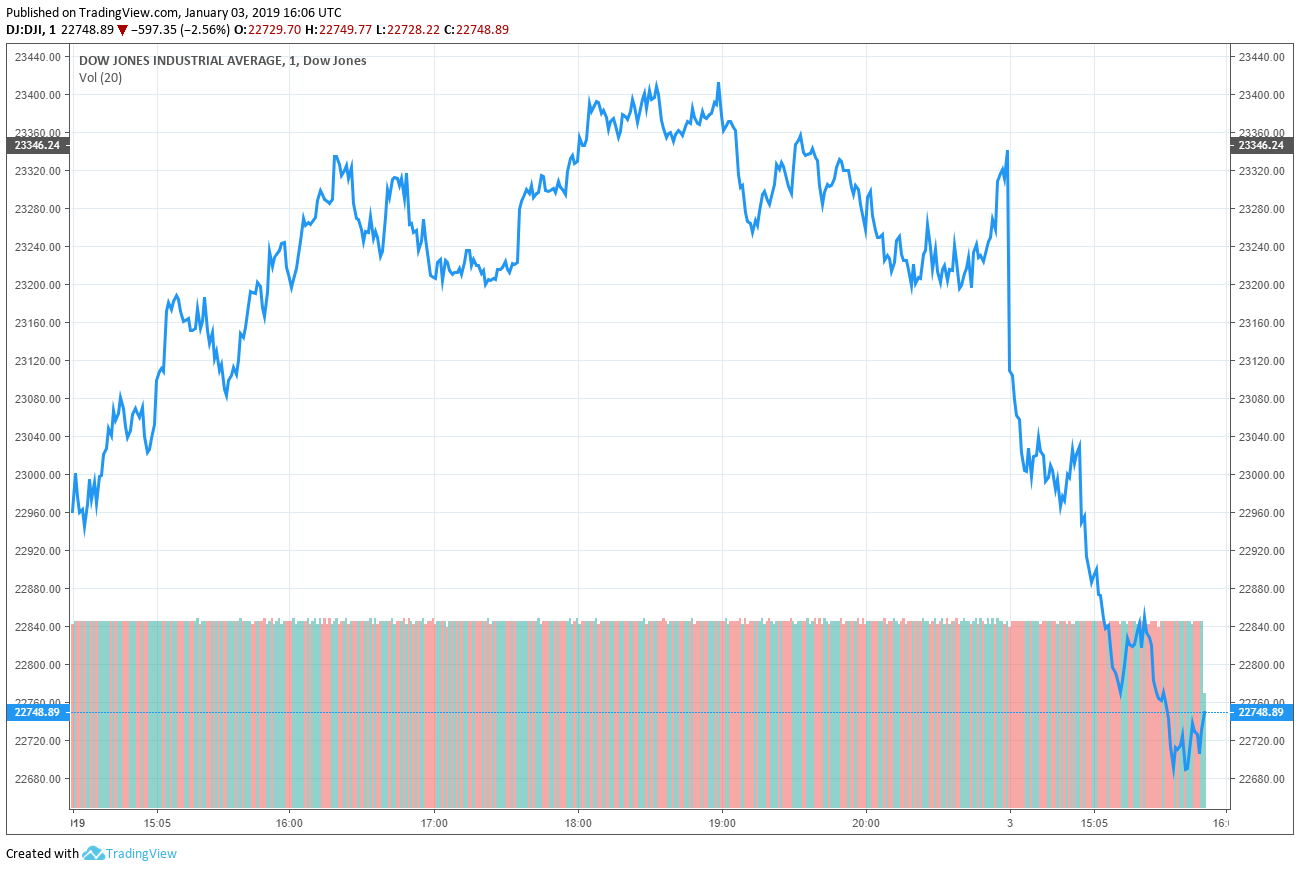

The Dow, S&P 500, and Nasdaq all plunged at the opening of trading today and continued to fall after Apple CEO Tim Cook suddenly revised Apple’s first-quarter revenue predictions. Apple shares have dropped nearly 10% as of the time of writing, putting the tech giant on track for its worst daily loss in more than half a decade.

Cook blamed ongoing trade disputes between the US and China in an interview with CNBC on Wednesday, saying:

If you look at our results, our shortfall is over 100 percent from iPhone and it’s primarily in greater China. It’s clear that the economy began to slow there in the second half and I believe the trade tensions between the United States and China put additional pressure on their economy.

Apple had predicted sales revenue for the first quarter of 2019 to be within a range of $89 to $93 billion, and analysts were sitting closer to a $91 billion prediction. The new forecast from Apple expects revenue to be as low as $84 billion, blaming China but also the slowing number of iPhone upgrades in other countries.

Cook penned a letter to investors informing them of the revised forecast, stating:

While we anticipated some challenges in key emerging markets, we did not foresee the magnitude of the economic deceleration, particularly in Greater China.

At the opening, the Dow fell 200 points, the S&P 0.7%, and the Nasdaq 1.2%.

Fueling a Slowdown?

Analysts are adding Apple’s predictions and their effects to fears of an economic slowdown. Jeff Kilburg, CEO of KKM Financial, said:

This piles on to existing anxiety of a slowdown in global growth, Apple can be used as a proxy to China’s growth.

Kit Juckes, strategist at Societe Generale, wrote in a note to clients this morning that Apple news is “feeding fears of slower global growth and further risk aversion.”

The impact is already being felt globally. Reports indicate that one Norwegian investment fund, the Norwegian Petroleum Fund, which has most of its assets in Apple, has lost the equivalent of $3 billion over recent months. Apple shares are some of the most widely held globally, so the impact of today’s plunge combined with the 30% decline over recent months will have repercussions.

At the time of writing, the Dow had fallen over 500 points.

Today’s losses at market opening could have been worse, as the newly-published ADP/Moody’s Analytics jobs report showed US private sector jobs up nearly 300,000, which may have offset some of the decreasing market confidence in recent hours.

Will US President Donald Trump call today’s crash another glitch?

Featured Image from Shutterstock. Price Charts from TradingView.

We are hiring full-time and part-time journalists based in the United States. Ideal candidates will have extensive knowledge of traditional markets and/or the cryptocurrency industry. Apply for a position here.