The price of gold futures broke the $1,300 per ounce threshold for the first time since June 2018. Investors are likely moving positions to the gold markets, pushed away from stocks after recent dips. The crypto market capitalization, or the total amount invested in bitcoin and other cryptocurrencies, is also holding nicely, showing that cryptocurrency markets may yet provide an alternative haven for disgruntled institutional investors.

Gold Markets Rally

Long seen as a safe haven in times of volatility, gold is once again proving its value. Gold futures rose 0.4%, reaching slightly above $1,300 before dropping back below.

#Gold smashed its way to $1,300 an ounce to extend a new year rally as global central banks could be forced to open the monetary floodgates again. https://t.co/JWRUQu7gMH pic.twitter.com/oNib16a8EM

— Holger Zschaepitz (@Schuldensuehner) January 4, 2019

The spot price of gold rose too but failed to break the $1,300 threshold.

Rainer Michael Preiss, executive director at Taurus Wealth Advisors, told Bloomberg:

This rally in gold is based on investors increasingly realizing that gold is ‘safe money.’

George Gero at RBC Wealth Management added:

The market has major worries about the economy, the stock market and political events. If investors keep looking for havens, the price could reach $1,350.

The price of gold is rising as stock markets fall in response to global uncertainty. That uncertainty is fueled by trade disputes, US Federal Reserve interest rates hikes, and rising government debt. The economic contraction in China, the world’s second-largest economy, is having a knock-on effect this week. This caused Apple to revise its first-quarter sales forecast and sent stock prices spiraling downwards.

Ole Hansen, head of commodity strategy at Saxo Bank A/S, says if the current trends of dollar weakness, stock market volatility, and bond yields falling continue, “then gold will continue to assert its role as a safe haven.”

Cryptocurrency Markets – A New Safe Haven?

Could another, new safe haven exist for times of economic uncertainty and stock market volatility? This year will be the first-time cryptocurrencies exist in a time of interest rate hikes, stock market depressions, and quantitative easing. Gold is a go-to for its lack of volatility and enduring steadiness as an asset. Cryptocurrency prices are volatile, more so than stocks and other assets, so technically cryptocurrencies should not be a safe haven — but could they be?

The cryptocurrency market provides an alternative asset class far outside the realm of government monetary policy, and this could add trust to a market attractive to those who are averse to decentralization. Bitcoin could become a go-to for disgruntled stock market investors, and some predict they could outperform other asset classes in 2019.

Though cryptocurrency prices are not hiking over the last 24 hours like gold, current global market volatility is also not causing investors to leave the space either. Considering the dismal cryptocurrency market performance of 2018, this could be a very positive sign.

Cryptocurrency market capitalization has been holding relatively steady, around $130 billion, for a few weeks and notably since the last US Federal Reserve interest rate hike.

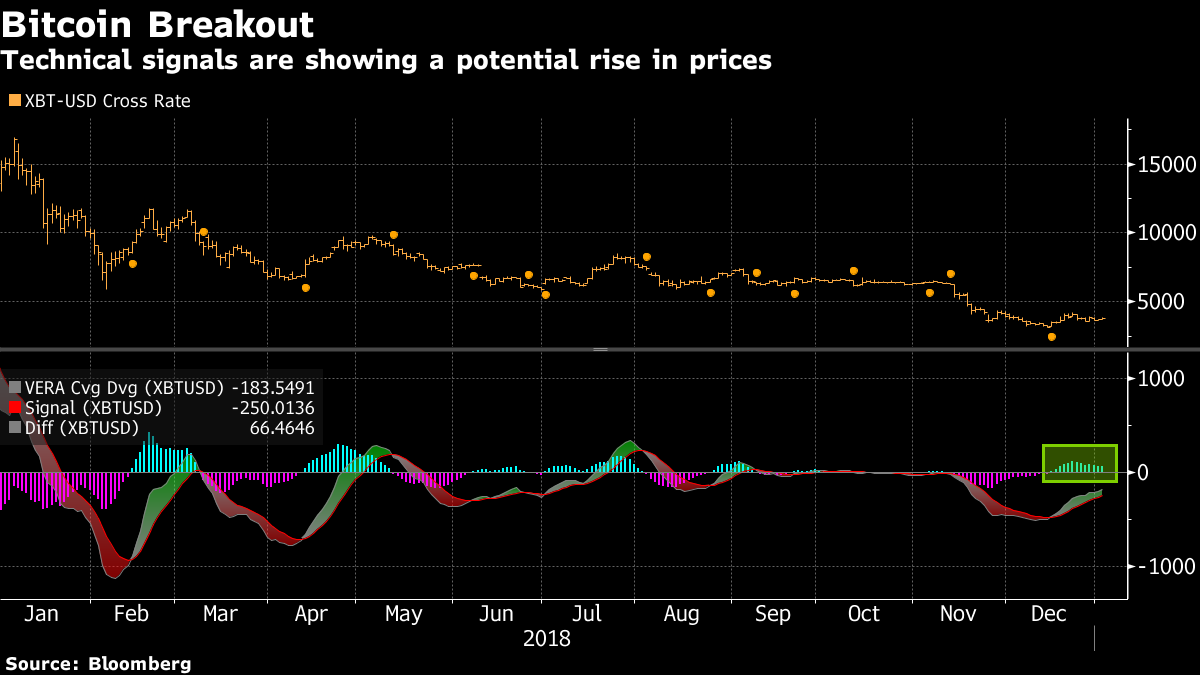

Bitcoin’s price once again failed to break through its resistance point of $4,000 again this week. But, Bloomberg says the GTI Vera Convergence Divergence indicator is suggesting bitcoin is entering a buying streak, and its price could continue to rise:

Amidst the stock markets so-called “mid-life crisis,” gold markets are rallying, and the cryptocurrency market could be quick to follow. So far today, Ethereum (ETH) is leading the charge, up 1% over the last 24 hours after surging 19% on January 2.

Featured Image from Shutterstock

![In Gold [and Bitcoin?] We Trust: Precious Metals Surge as Stocks Fall](https://the-ecoin.com/wp-content/uploads/2019/01/0b5bafb3103d305aa9be5d56a5c023b4-740x357.jpeg)