Renowned economist, author of the “Death of Money,” Jim Rickards says the markets just “got the cue” they need. The U.S Federal Reserve (FED) is now unlikely to raise interest rates again without significant warning. That’s a green light for the stock markets and indeed the cryptocurrency market.

Powell’s use of “patient” on Friday was not a throwaway. It’s Fed-speak for “We won’t raise rates without letting you know.” They’ll do that by removing “patient” as Yellen did in March 2015. For now, it’s a green light for carry trades and risk on behavior. Market got the cue. pic.twitter.com/A6190y6DAT

— Jim Rickards (@JamesGRickards) January 5, 2019

Federal Reserve Chairman Jerome Powell appears to be responding to market and economic uncertainty. As well as perhaps pressure from the U.S president. On Friday he pledged to be “patient” saying:

“As always, there is no preset path for policy, and particularly with muted inflation readings that we’ve seen coming in, we will be patient as we watch to see how the economy evolves.”

What this means, says Rickards, is the Federal Reserve will first revoke this “patient” promise before going ahead and considering further rate hikes.

Precedent Suggests No Interest Rate Hikes Until 2020 or Later

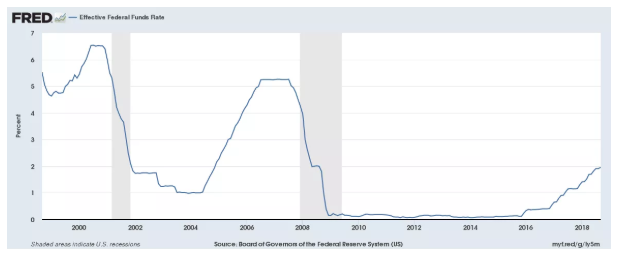

In 2015, then Federal Reserve chair Janet Yellen warned the Federal Reserve may remove a prior “patient” promise from December 2014. At the time, removing said promise in March still meant rate hikes weren’t likely until June of that year. In the end, the Federal Reserve didn’t start hiking interest rates, from a then level of 0.25%, until December 2016.

Hence a “patient” promise from Powell, if it formulates into an official policy statement, could mean no hikes for 2019. If 2015 is anything to go by, now the Federal Reserve might not consider hiking interest rates until 2020.

Powell is Responding to Threat of Recession

The positive U.S jobs report suggests there is no need for the Federal Reserve to change its monetary policy.

However, there are a number of other factors which may mean the U.S and the globe is teetering on a downturn. These reasons include trade issues and stock market volatility. As well as the performance of other major economies like China and Europe.

Considering the standpoint of U.S president Donald Trump, the Federal Reserve has no government support to continue rate hikes. And, though not as steep as other historic rate increase periods, hikes have been frequent. Further reasons why the Federal Reserve could adopt a wait and see approach instead of risking plunging the U.S back into depression. Powell said Friday:

“We will be prepared to adjust policy quickly and flexibly and to use all of our tools to support the economy should that be appropriate to keep the expansion on track, to keep the labor market strong and to keep inflation near 2 percent.”

Bets on a Rate Cut

CNBC Mad Money host Jim Cramer also said the prospect of rate hikes can be taken “off the table” and that:

“I bet a ton of money actually flows back into the market given that Powell’s come around. He gave this market a huge and justifiable boost: the Powell Pop. Suddenly, the biggest negative had been removed.”

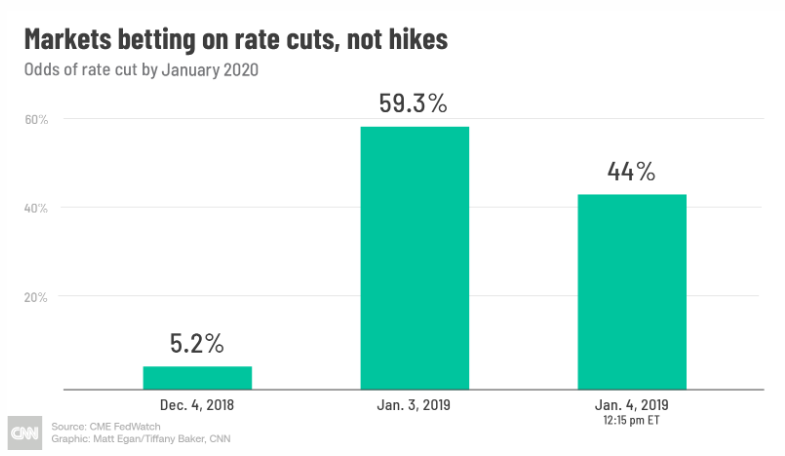

Additionally, the CME FedWatch Tool had the odds of another rate hike by January 2020 at 70% in December 2018. When the Dow plunged 660 points Thursday that probability fell to zero percent. It rose to a 1.8% chance of a rate hike before 2020 on Friday with the publication of the jobs report.

In fact, Wall Street now expects a rate cut before January 2020.

While a further rate increase in 2019 cannot be ruled out, it now looks very unlikely. The stock markets will still roil for some time off the back recent increases too. But Powell may well have taken the pressure off, and we could see a decent market recovery follow.

Featured image from Shutterstock.