Late last night on Twitter, the official Ethereum Classic team noted that possible chain reorganization and double spend attacks are ongoing. They subsequently asked crypto exchanges and ETC mining pools to require as many as 400 confirmations for withdrawals and deposits.

There have been rumors of a possible chain reorganization or double spend attack.

From what we can tell the ETC network is operating normally.

BlockScout’s “Reorg” section shows nothing of the sort.https://t.co/Yi2cXusCz9 pic.twitter.com/HdUtS0DJZK

— Ethereum Classic (@eth_classic) January 6, 2019

The team noted that, to their knowledge, the ETC network is operating normally.

Chain Reorganizations and Double-Spends Afoot?

A chain reorganization is when a client in most blockchain designs discovers a longer chain which disregards blocks it had previously processed. “The longest chain wins” is one of the rules of decentralized networks. “Longest chain” is defined by various metrics including difficulty (the most miners were mining this version).

51% attacks are based on the concept of the longest chain. If a miner has enough hash power, they can essentially rewrite a blockchain to suit their needs. They can pay for goods, services, or even other cryptocurrencies and then rewrite the history of the blockchain so that these transactions never actually happened.

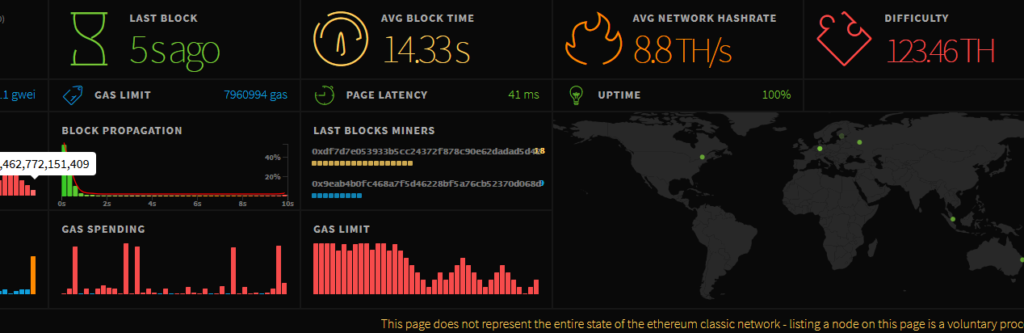

A 51% attack on the Bitcoin network is probably too expensive at present. However, Ethereum Classic does not enjoy the massive hashpower that Bitcoin and Ethereum have. According to ETCSTATS.net, at the time of writing they had just 8.8 terrahash. Compare this to Bitcoin, which has over 39 million terrashash at time of writing. Or a closer comparison to Ethereum proper, which has 190 TH/s.

These numbers represent the amount of hashpower that would be required to effect a chain reorganization or a double spend attack. As such, it is significantly less expensive to double-spend or create a reorganization on the Ethereum Classic network than it is on some others. It is still more expensive on the almost $600 million network than it is on many.

Ethereum Classic Exchanges Put on Notice

The ETC team stresses that they believe everything is fine. However, in a follow-up tweet they asked mining pools and exchanges to require as many as 400 confirmations.

To all exchanges and mining pools please allow a significantly higher confirmation time on withdrawals and deposits (+400)

cc @OKEx @ExchangeXGroup @HuobiGroup @digifinex @binance @bitfinex https://t.co/m5cxcKBVXa

— Ethereum Classic (@eth_classic) January 7, 2019

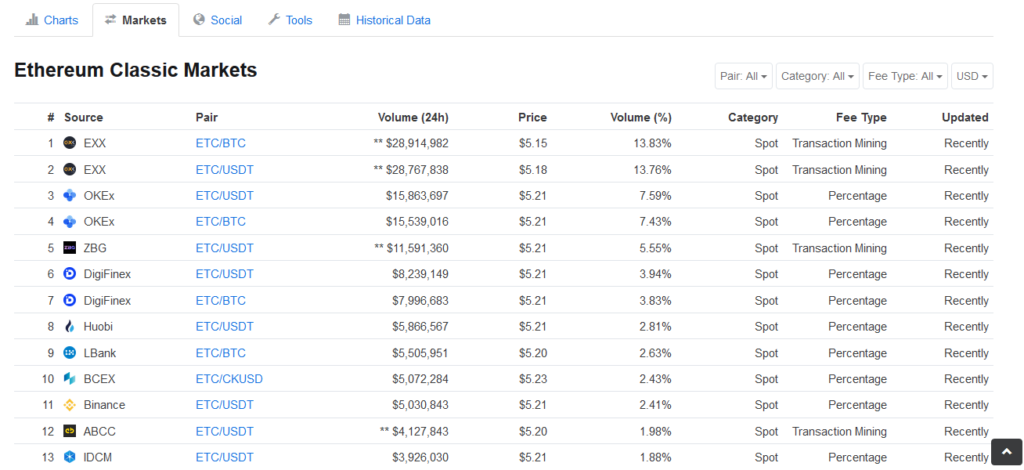

They specifically tagged OKEx, the exchange where most of their volume takes place, along with some others. Compared to other cryptocurrencies, however, Ethereum Classic trading is pretty evenly spread across exchanges:

Increasing the number of required confirmations reduces the likelihood of victimization. It takes more hashpower for each additional block a nefarious miner wishes to republish or erase from the blockchain. Too much chaos results in a “hard fork.” The majority of the network decides which chain it will accept going forward.

Ethereum Classic itself comes from a hard fork surrounding an early bug in Ethereum. The legendary DAO Hack led some Ethereum community members to disagree with the decision to hard fork and preserve the original chain.

Update 1/7: The Ethereum Classic Twitter account posted an update that may provide clarity on the situation. The post claims that a crypto mining manufacturer was testing out a batch of new devices and engaged in selfish mining.

Regarding the recent mining events. We may have an idea of where the hashrate came from.

ASIC manufacturer Linzhi confirmed testing of new 1,400/Mh ethash machines #projectLavaSnow

– Most likely selfish mining (Not 51% attack)

– Double spends not detected (Miner dumped bocks)— Ethereum Classic (@eth_classic) January 7, 2019

Disclosure: The author holds an investment position in ETC.

Featured Image from Shutterstock