How much is one bitcoin worth? In fiat currency terms, that’s a constantly shifting answer, but ever since the beginning, the following has held true: one bitcoin is worth as much as the buyer is willing to pay. Today, that’s likely to be a few thousand dollars, but back in the day, the reverse was more likely to be true: for one dollar, you could buy several thousand bitcoins.

Also read: Bitcoin History Part 7: The First Major Hack

Calculating Bitcoin’s Exchange Rate

Once an asset has a universally agreed exchange rate, tracking its rising and falling price thereafter is a simple matter. But when no one’s really sure what the market is willing to pay for an emerging asset, it can be hard to reach consensus on valuation – especially when there are no exchanges to facilitate price discovery. This was the dilemma that early Bitcoin adopters faced in early 2010.

Once an asset has a universally agreed exchange rate, tracking its rising and falling price thereafter is a simple matter. But when no one’s really sure what the market is willing to pay for an emerging asset, it can be hard to reach consensus on valuation – especially when there are no exchanges to facilitate price discovery. This was the dilemma that early Bitcoin adopters faced in early 2010.

‘We are in a sort of “chicken and egg” situation at the moment,” noted Bitcointalk forum member The Madhatter. “In order for an exchanger to sell bitcoins … to someone, they need customers who have dollars and want coins … I mean, why would an exchanger sit around and accept bitcoins that are generated on your computers? They are going to just blow out their float of dollars and fold.” A couple of months prior, the first rudimentary exchange rate for BTC had been calculated by influential forum user “NewLibertyStandard” (aka NLS). Their pricing system was based on the amount of energy required to mine BTC – or “BC” as it was still often referred to at the time.

A Simple Model to Get the Ball Rolling

“New Liberty Standard is doing fantastic and logical work to help ‘set the ball rolling’,” praised forum user “BitcoinFX” on Feb. 5, 2010, adding: “I’m currently compiling a Neural Network model that takes into account other factors such as the finite number of Bitcoins, daily Gold and Silver fixings, other currency pairs and daily exchange rates and the average number of Bitcoin users etc. I’m of course factoring in the New Liberty Standard. This will be a very adaptable model to help calculate and predict future exchange rates and I will share it with our growing community.”

Today, the pricing models used to predict future bitcoin prices have become infinitely more sophisticated, but even in 2010, it’s evident that some adopters were thinking beyond mere extraction costs, and trying to envisage a world in which Bitcoin broke away from its power pegged price and attained a value determined by an array of external forces.

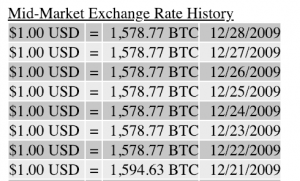

While NLS’s methodology has long since been retired, an archived web page reveals the BTC prices their system set back in 2009, explaining:

Our exchange rate is calculated by dividing $1.00 by the average amount of electricity required to run a computer with high CPU for a year, 1331.5 kWh, multiplied by the the average residential cost of electricity in the United States for the previous year, $0.1136, divided by 12 months divided by the number of bitcoins generated by my computer over the past 30 days.

In Dec. 28, 2009, according to NLS, $1 would have gotten you 1,578.77 BTC. Not bad.

Bitcoin History is a multipart series from news.Bitcoin.com charting pivotal moments in the evolution of the world’s first and finest cryptocurrency. Read part seven here.

Images courtesy of Shutterstock.

Need to calculate your bitcoin holdings? Check our tools section.