Global markets are at a major pivot point. We made this point recently in our 5 must-see charts on a global market crash as well as our stock market crash 2019 in 12 charts. All the leading indicators we track are available in those 2 articles. On top of this we feature in this article 2 stock market charts which will be crucial in 2019. One is the financial sector which may turn stock markets bullish again. The other one is the health sector which, provided stocks become bullish, will have quite some winners.

We do not only feature a stock chart because we believe it should be traded. More importantly, we feature stock charts, or sector charts, because of their meaning within this universe of financial markets.

That’s what intermarket dynamics are all about as explained in our 100 investing tips.

Markets move in relation to each other, they do not move in a vacuum. Capital flows from one market to another market, considering that cash is also a market (any currency). This flow of capital can be identified by thoroughly analyzing chart patterns and trends in a handful of leading assets. They are primarily treasuries, currencies, leading stock market indices, gold, crude oil.

That’s how to interpret the financial sector chart we feature in this article.

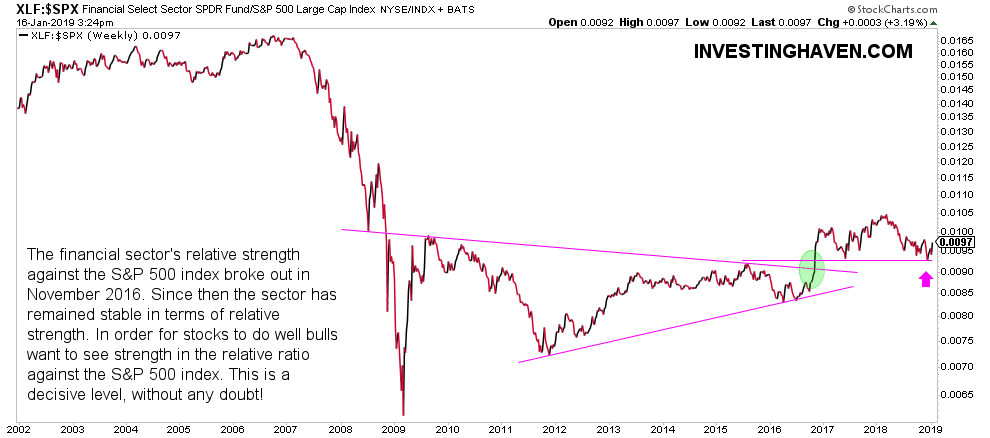

Specifically, the financial sector relative strength against the S&P 500 index is an important indicator according to us. Not only for the financial sector, but, more importantly, for global stock markets.

The financial sector relative strength against the S&P 500 index broke out in November 2016. Since then the sector has remained stable in terms of relative strength. In order for stocks to do well bulls want to see strength in the relative ratio against the S&P 500 index. This is a decisive level, without any doubt!

The second must-see stock chart is not a leading indicator but probably an outperformer, if and once stock markets become bullish again.

In other words this is a sector that should be looked at to identify future winners, the type of stocks you want to hold if we know for sure that the stock bull market continues.

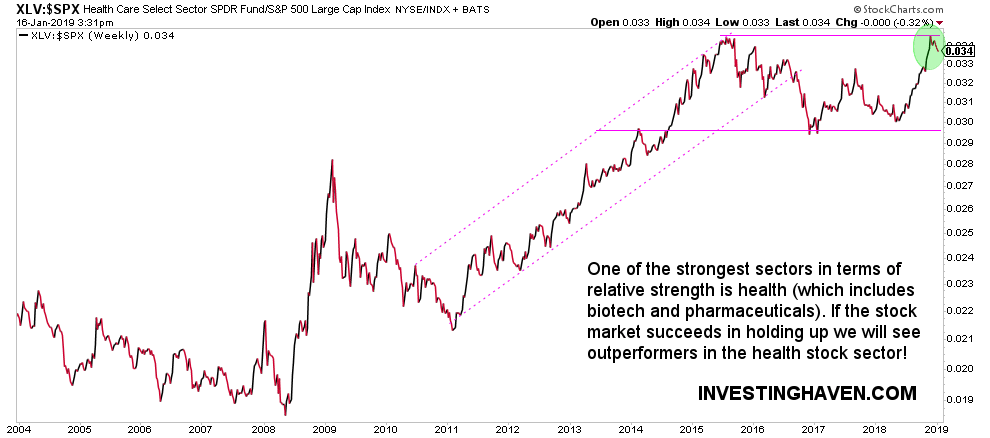

One of the strongest sectors in terms of relative strength is health. If the stock market succeeds in holding up we will see outperformers in the health stock sector!

The health sector includes biotech and pharmaceuticals. We believe this is one of the places to look for outperforming stocks once we get a confirmation that stock markets won’t go much lower from here.

TOP CRYPTOCURRENCIES TO BUY: Which top crypto tips are flashing a BUY signal now? Which to avoid? Top notch guidance on how to play the grand bull market in crypto from InvestingHaven’s research team, only for $2 per week. Crypto & Blockchain investing service >>