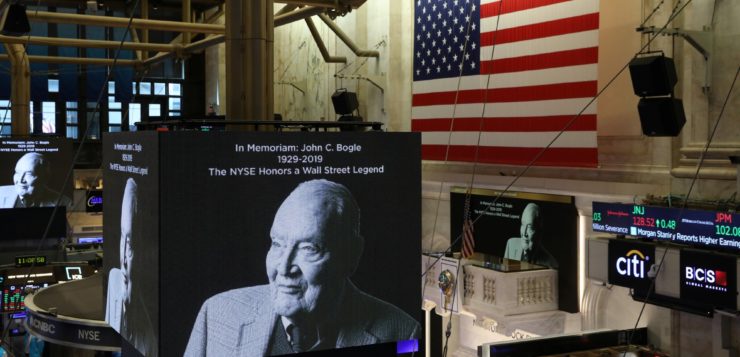

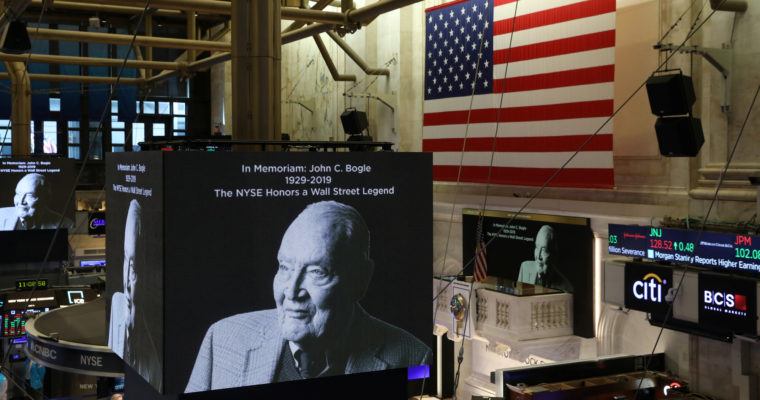

Legendary investor John Bogle, founder of Vanguard Group (with over $5.1 trillion in assets under management) along with an entire philosophy for investing in equities, and a loyal following of “Bogleheads,” died Wednesday at the age of 89. And his enduring contribution to the investing world is his 1975 invention– the creation of the first index mutual fund for individual investors.

Bogle was bugged by active asset management fees charged by professional investors that he felt were too high and eating into their clients’ profits without delivering enough performance.

19th Century railroad and shipping magnate Cornelius Vanderbilt once said,

“I don’t care half so much about making money as I do about making my point, and coming out ahead.”

Maybe that’s what John Bogle was thinking in 1975 when he started Vanguard Group and then set about proving his point that active management fees weren’t really worth it by creating the first retail mutual index fund in 1976. As William Baldwin recounts at Forbes:

“The fund bought every stock in the S&P 500 index and set about delivering the market’s average return. The product was, at first, a sales flop. Who wanted guaranteed mediocrity?

But if you hire a money manager to beat the market you have to pay—and you pay whether or not the manager succeeds. You might get lucky for a year or five or ten. Eventually, though, your luck will run out. With each passing year it becomes more likely that you will be overtaken by the law of averages.”

In a way, you could say that John Bogle was a pioneer in algorithmic investing. His simple and important idea was that a few simple rules could manage a stock portfolio for better returns than a human sweating over it every day. That’s an investing algorithm, and it’s one that is simple enough that it could be written as contractual policy and executed by a small business.

John Bogle’s Simple Investment Rules

His simple rules were to buy the entire stock market and deliver the average of its returns. They were based on the investing principle of diversification to mitigate losses.

(Don’t put all your eggs in one basket and definitely don’t then pay some big fees to someone to manage that basket even if they send it back to you with fewer eggs!)

And John Bogle’s reckoning that overall, over enough time, the U.S. economy will move in a healthily more profitable direction, as losses and gains average out to steady, healthy profits while fees are kept super thin. Sounds quite reasonable.

Did it turn out to be true? Yes and no.

From Investopedia: “The average annualized total return for the S&P 500 index over the past 90 years was 9.8%.” Well, that’s not bad. But have there been any ten year periods in which the S&P 500 actually depreciated in value? Yes there have, so even diversifying your stock portfolio to the point of just buying the S&P 500 is no guarantee that this asset class will grow or even be what it’s worth today over ten years, and volatility on that scale could be a financial disaster.

The best ten-year return for the S&P 500 was from 1990 – 2000, with a return of 20% a year. 1990 was a good year to invest in the S&P 500 index mutual fund with John Bogle. The worst ten-year return for the S&P 500 was from 1999 – 2009, with a loss of 3% a year. 1999 was a bad year to invest in the S&P 500 with John Bogle.

A theory: That lost decade of economic growth was the hidden tax to pay for the all of the United States and NATO’s military interventions in armed conflicts and political controversies all over the planet starting in 1990 through the Iraq War.

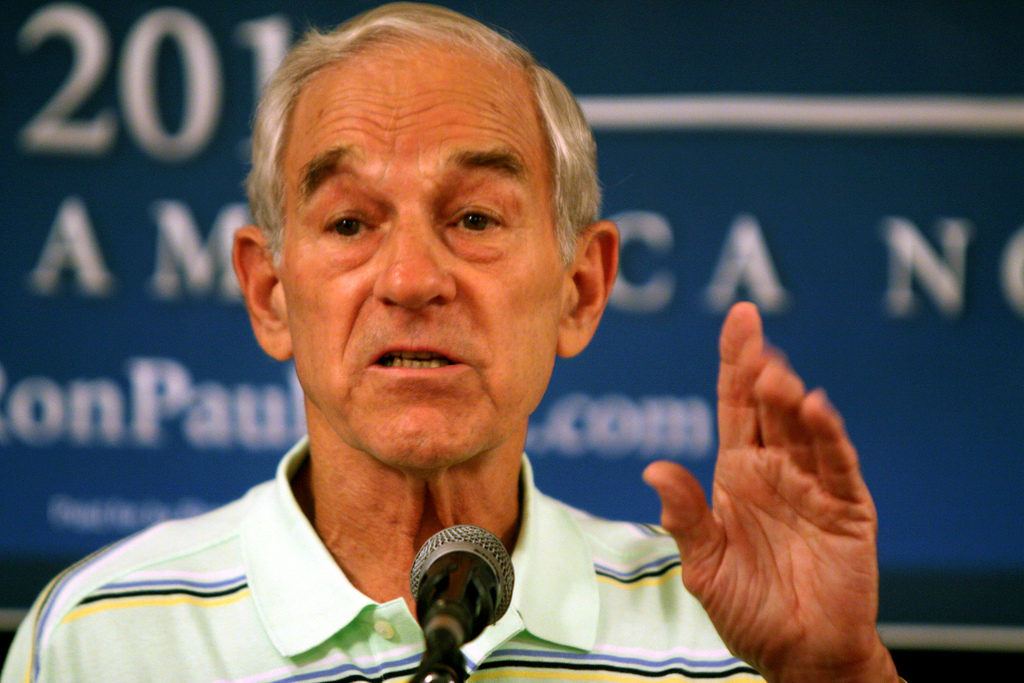

Now let’s say you had invested instead with Texas Congressman and three-time presidential candidate Ron Paul back in 1999 instead of bought the stock market with John Bogle.

Let’s say you had bought and held gold like Ron Paul has been advising people to do since the 1970s when he first ran for Congress.

Instead of your investment bleeding 3% for ten years while the Federal Reserve bank ran the printing press to pay for the invasion of the Middle East, plus bailouts for Wall Street businesses that lost stupid amounts of money, and the ongoing massive social welfare bureaucracies, your gold would have made a nice 14.83% return.

Which is why an index fund could be viewed as not diverse enough, because all it does is diversify within a single asset class, not across them. That’s why a lot of people are investing in hard assets like private digital currencies and precious metals, as well as equities like index funds and ETFs, and stocks for companies they know something about and believe in.

Now that’s a diverse portfolio, but I bet John Bogle’s wife Eve Bogle was glad she didn’t diversify. Rest in Peace Mr. Bogle. We salute you.