By CCN.com: Investment manager VanEck remains confident about its bitcoin ETF application, despite the US government shutdown. Why? Because the firm believes it has laid a robust foundation for the VanEck/SolidX Bitcoin ETF to eventually win SEC approval.

“I have done everything I can to build the right market structure for Bitcoin and digital assets,” VanEck’s director of asset strategy, Gabor Gurbacs, told CCN on Twitter.

The Securities and Exchange Commission has placed a hold on all administrative functions due to the ongoing shutdown, according to a Jan. 16 statement.

The SEC has until February 27 to approve or deny VanEck’s bitcoin ETF application. As CCN reported, the agency delayed making a decision on it several times in 2018.

Lawyer: Prolonged Shutdown Reduces Chance of Automatic SEC Approval

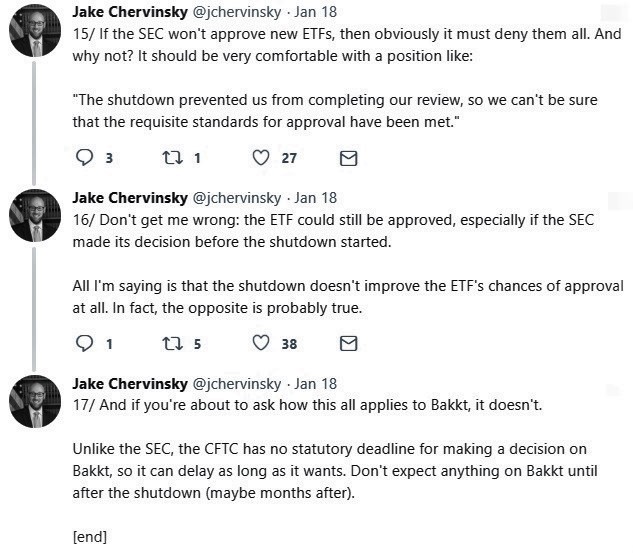

Blockchain attorney Jake Chervinsky says VanEck’s bitcoin ETF application won’t automatically be approved in the event the shutdown extends past Feb. 27.

“The SEC’s final deadline to approve or deny the ETF is February 27,” Chervinsky tweeted. “That’s 240 days after the ETF proposal was first published in the Federal Register.”

The SEC doesn’t have the power to extend the 240-day deadline. The statute absolutely prohibits any further delays.

By law, that means if the SEC fails to make a decision by the February 27 deadline, the ETF will be automatically approved.

5/ It’s true that the SEC has stopped nearly all of its work due to the shutdown & furloughed most of its employees (they have to stay home).

That includes the majority of staff members in the Division of Trading & Markets, which handles proposed rule changes (including ETFs).

— Jake Chervinsky (@jchervinsky) January 18, 2019

Chervinsky says a skeleton crew at the SEC is working during the shutdown to make sure the agency does not miss deadlines.

As it is, regulatory agencies generally tend to favor being too restrictive over not being restrictive enough.

“If the shutdown continues to February 27, I think the ETF’s chance of approval is near zero,” Chervinsky says.

Chervinsky says he could be wrong, but warned that the shutdown doesn’t boost the bitcoin ETF’s chances for approval.

VanEck’s Gabor Gurbacs Not Sweating Shutdown

Meanwhile, Gabor Gurbacs is unfazed about the impact the shutdown will have on the SEC’s decision.

On Saturday (Jan. 19), Gurbacs playfully tweeted a gym workout video where he jokingly referred to himself as the “Bitcoin Soldier.”

In response, the author good-naturedly trolled him on Twitter. He reacted by reaffirming his firm’s position that they did all they could to ensure SEC approval, and left it all on the field.

Longing, rusted, furnace, daybreak…merkle, beastmode. (The Bitcoin soldier) pic.twitter.com/24Ecp1JGAt

— Gabor Gurbacs (@gaborgurbacs) January 19, 2019

As CCN reported, Gurbacs is confident that SEC approval is around the corner. “America wants a bitcoin ETF and we are here to build it,” Gurbacs said in December 2018.

We think that we’ve met all market structure obstacles and requirements on pricing, custody, valuation, and safekeeping, so we are cautiously optimistic.

Nasdaq to Launch Bitcoin Futures In Q1

Regardless of the SEC outcome, VanEck is plowing ahead to launch bitcoin futures in 2019 through a partnership with Nasdaq.

Nasdaq — the world’s second-largest stock exchange — has been working with the Commodity Futures Trading Commission to ensure that it complies with any pending regulatory issues.

In December, Gurbacs noted that VanEck also “ran a few extra miles working with the CFTC to bring about new standards for custody and surveillance.”

Nasdaq to Launch ‘Bitcoin Futures 2.0’ in Early 2019 https://t.co/VSD7ouQaTs

— CCN.com (@CryptoCoinsNews) November 29, 2018

Meanwhile, Nasdaq’s rival ICE (Intercontinental Exchange) — the parent company of the New York Stock Exchange — also intends to unveil a physically-settled bitcoin futures product in the first quarter. Bakkt, the crypto exchange built by ICE, plans to launch its bitcoin futures market soon, though there have been delays. There’s a lot happening in the crypto market this quarter. So stay tuned.

Featured Image from Shutterstock