/latest/2019/01/the-week-cboe-pulls-bitcoin-etf-application-xrp-market-cap-possibly-overstated/

This week saw some important developments, the most notable being the withdrawal by CBOE of the hotly-anticipated VanEck-Solidx ETF during the US government shutdown. With bitcoin dropping over 3% and ether by more than 10%, this week also saw research from Messari claiming that XRP’s market cap is likely overstated by more than $6 billion.

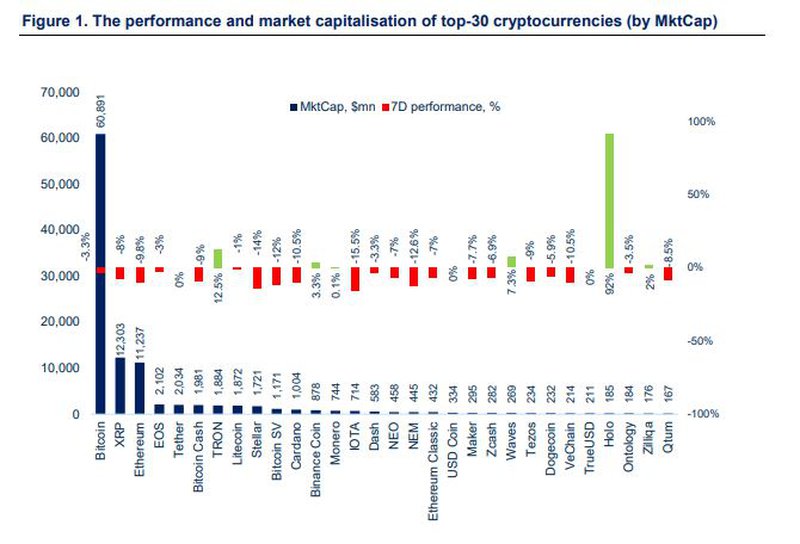

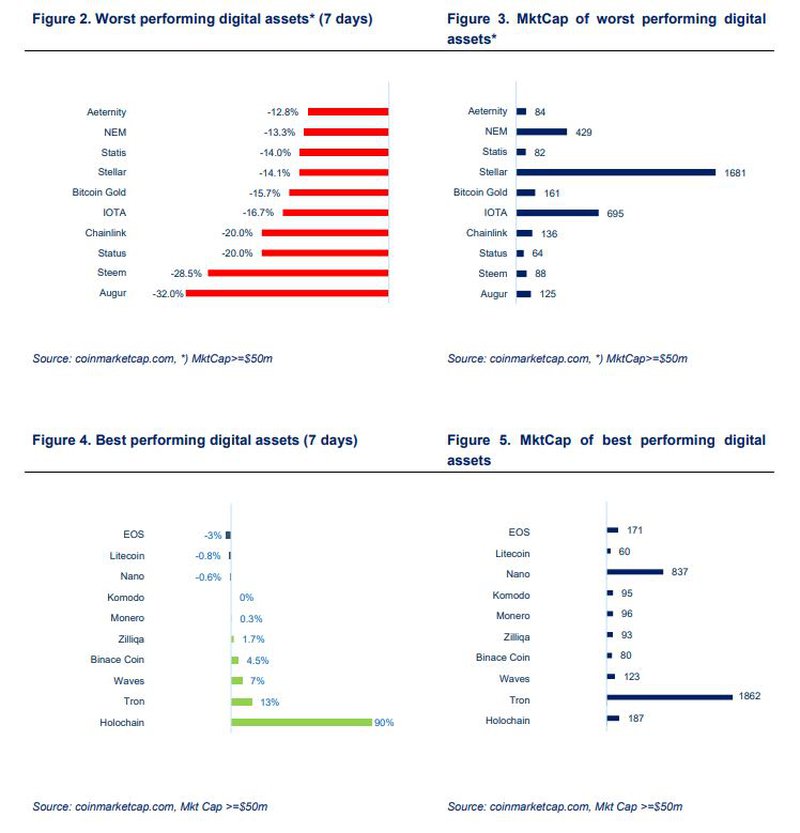

The cryptocurrency market has lost almost $7bn as of this morning, after a relatively stable previous week of ranging around a $120bn total market cap. Bitcoin has fallen by more than 5% from last week’s high of $3,650 and has bounced off the bottom of the six week trading channel at $3,450. Ethereum is down by 10% at $107, with the next support build around $100. Ripple has only lost 8% in the morning dump, and even though the company has been accused of manipulation of their market cap, XRP did not react to this news and remains the second largest asset. BCH is down almost 18%, EOS and Litecoin are down by 8%. The overall volume has spiked by 15% and the dominance of market leader bitcoin is up by 1.3% compared to last week. Last week’s best performing top-30 assets were Holochain (+92%), Tron (+12.4%), Waves (+5.6%) and Binance Coin (+2.5%).

Regulatory News

CBOE Pulls Bitcoin ETF Application due to a Government Shutdown

Cboe Global Markets and its partners VanEck & SolidX have withdrawn their highly anticipated bitcoin ETF application before the SEC’s decision deadline on 27th February. According to VanEck CEO, Jan van Eck, the proposal was being withdrawn and would be re-submitted once, “the SEC gets going again”.

Italian Regulators Introduce Blockchain Regulation Document

The Italian Senate committee has approved a blockchain regulatory document which now requires two additional approvals from the Italian Parliament. If approved, a new law would essentially legalize blockchain timestamping and validation of digital documents.

Robinhood and LibertyX Receive BitLicenses

Stock and cryptocurrency trading app Robinhood together with LibertyX, a firm which allows its customers to buy Bitcoin with debit cards from ATMs, has received permission (BitLicense) to operate in the state of New York.

Dutch Regulators Plan Crypto License Scheme

Financial Authorities in the Netherlands are recommending a licensing regime instead of just a registration system for crypto exchanges and custodians as they carry “high financial crime risks”. While licensing allows pre-market entry assessment to understand if involved parties are able to comply, registration only allows for a limited substantive assessment and would be therefore less effective.

FCA Proposes Guidance on Regulation of Crypto Assets

The UK’s Financial Conduct Authority launched a comprehensive consultation on how regulation should be applied to crypto assets, exchanges, wallet providers, payment companies and brokers. The guidance aims to help firms “understand whether certain crypto assets fall within the regulatory perimeter”.

Security Token News

Hg Exchange to Tokenize AirBnBs and Ubers of the World

Crypto startups Zilliqa and Maicoin have announced their plans to launch security token platform Hg Exchange, which wants to tokenize Uber, AirBnB, SpaceX and other existing companies.

Securitize Joins IBM Accelerator Program

Security token issuance platform Securitize has been selected to join the IBM blockchain accelerator program, in order to tackle the $82T corporate debt market. “The potential for tokenizing the corporate debt market is a massive undertaking, but blockchain offers a means to reduce costs and time spent”, CEO Carlos Domingo stated.

tZERO Launches Trading Services

Highly anticipated security token secondary market tZERO, which raised more than $130m via STO in August, is now live. CEO Sam Nousalehi stated, “This will create liquidity, democratize access, bring transparency and efficiency to global markets and accelerate the adoption of security tokens”.

Crypto Market News

OKCoin Aims for Reverse IPO

The founder of crypto exchange OKCoin, Mingling Xu, has become the largest shareholder (60.49%) of LEAP Holdings Group, the publicly listed construction engineering firm in Hong Kong, and is one step closer to a reverse listing on the Hong Kong Stock Exchange (HKEX).

Galaxy Digital Raising $250m to Offer Loans to Crypto Firms

Galaxy Digital, the crypto merchant bank, is raising at least $250 million for its crypto credit fund, which aims to offer loans to struggling crypto businesses. Lenders will be able to get the loans by using cryptocurrencies, real estate or mining hardware as deposits.

Ripple (XRP) Market Cap May Be Overstated by almost 50%

According to crypto data firm Messari, Ripple’s market cap ($12.8bn) is “likely overstated” by more than $6 billion. Messari’s calculations estimate that out of 41 billion tokens, 19.2 billion may be illiquid or subject to significant selling restrictions. Ripple’s spokesperson has disputed Messari’s findings.

Coinbase Expands OTC Trading Services to Asia and Europe

Coinbase is launching its OTC trading services for high-volume customers in Asia and Europe. Simultaneously, the firm is launching cross-border wire transfers for clients in countries where fiat payments are not yet available.

Bithumb Seeks US Listing Via Reverse Merger

Singapore-based company BTHMB (Bithumb’s parent company) has signed a binding letter of intent agreement with Blockchain Industries, a firm traded on the US OTC markets, for the reverse merger deal. If the deal goes through, a newly formed entity, known as Blockchain Exchange Alliance (BXA), would become the first US-listed crypto exchange.

BitMEX Report on ICO Funds Allocation

Crypto exchange BitMEX and analytics firm TokenAnalyst have been looking into the treasury balances of more than 100 ICOs and have found out that teams have been allocated more than $24bn ($80bn peak valuation), from which the teams may have realized gains of around 20% by selling tokens.

Bitcoin Historic Correlations

Although the price fell significantly in 2018, bitcoin’s near-zero correlation with assets like gold, oil, US bonds, S&P 500 and others, proves bitcoin’s long-term store of value thesis.

Maduro Stymied in Bid to Pull $1.2 Billion Worth of Gold from U.K.

Here’s another appealing use case for unseizable digital assets like bitcoin as The Bank of England has blocked Venezuela’s president Nicolas Maduro’s withdrawal request of $1.2bn worth of gold held in the bank.

Komid Exchange Executives Sentenced to Jail for Faking Volume

Last week, South Korean executives of the crypto exchange Komid, received jail sentences after earning $45 million in fees yielded from 5 accounts which had been created for volume manipulation purposes.

Bakkt Bitcoin Futures Details

Even though the bitcoin futures trading platform is yet to gain approval from CFTC, Bakkt has announced the details of futures contracts.

Last Week in Funding

Symbiont raised $20m in Series B round from Nasdaq, Citigroup, Galaxy Digital and others. Crypto wallet BRD raised $15m in Series B from SBI Crypto Investment. Investment platform Coinhouse raised $2.8m in Series A round led by ConsenSys Ventures. RealBlocks raised $3.1m seed round to tokenize real estate.