Emerging markets and their respective currencies are on the rise, which historically has had some correlation with the price of Bitcoin.

According to Morgan Stanley, the global emerging markets benchmark is expected to rise by around 8 percent in 2019, primarily due to the increase in interest in the Chinese stock market following the optimistic prospect of the trade deal.

BITCOIN VS. EMERGING MARKETS: WHAT’S THE CORRELATION?

In August 2018, global macro analyst Peter Tchir said that during periods of emerging market stress, cryptocurrencies like Bitcoin as a store of value are expected to rise.

He said:

I would have expected bitcoin and cryptocurrencies to do well in times of emerging market stress. If you live in an emerging market country, where the political situation is tenuous and your currency is devaluing rapidly, it would make sense to want to store it, or hide it, or invest it in cryptocurrency. In theory Bitcoin is the ideal ‘hedge’ for a person of wealth in such a situation.

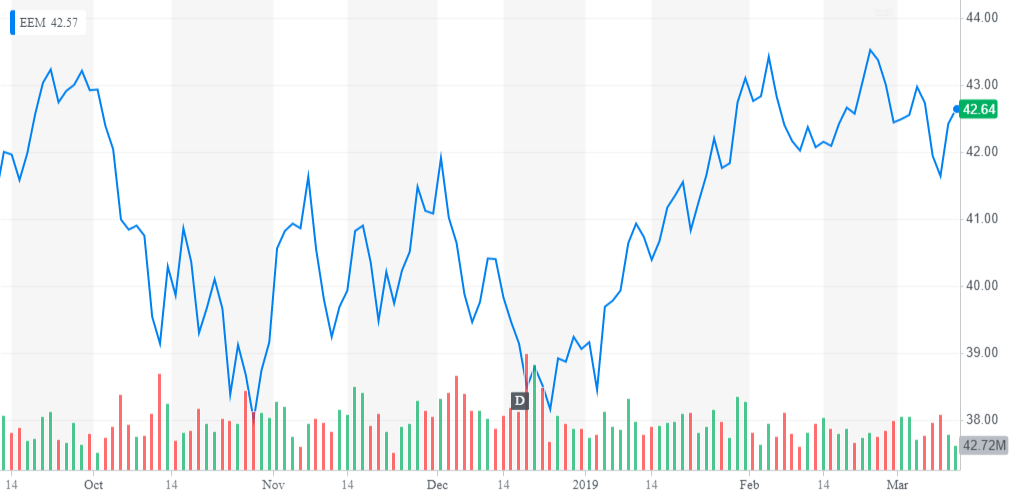

But, Bitcoin has continued to follow the price trend of emerging markets benchmarks like the MSCI EM index to the downside.

Investors and strategists expected emerging markets and Bitcoin to demonstrate an inverse correlation. Throughout 2018, the two had consistently shown correlation and if the MSCI EM index moves up by 8 percent the year’s end, it could have a positive effect on the prices of cryptocurrencies.

Speaking to CNBC’s Trading Nation, Fundstrat Global Advisors head of research Tom Lee said in late 2018 that until emerging markets face a trend reversal to the upside, it is difficult to imagine many investors would be compelled to commit to the cryptocurrency market.

Emerging Markets ETF 6-Month Chart (Source: Yahoo Finance)

Read more at: https://www.ccn.com/emerging-markets-bitcoin-surges-near-term