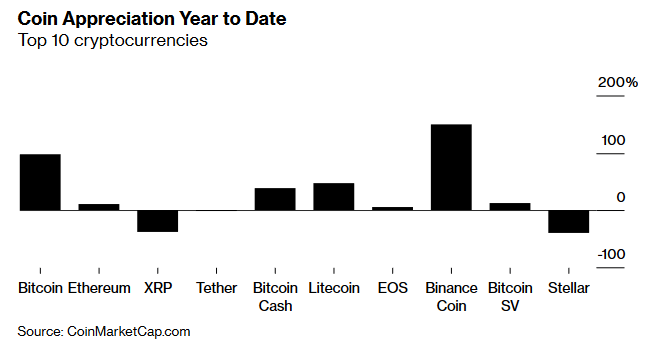

Only one major cryptocurrency has outperformed industry bellwether Bitcoin this year — the namesake token from the contentious exchange Binance Holdings.

Binance Coin, usually referred to as BNB, has surged about 150%, according to CoinMarketCap.com. Eight of the top-10 coins by market capitalization either decreased in price or appreciated much less in a year where Bitcoin has doubled.

A favorite of crypto hedge funds and large traders since its 2017 introduction, BNB lets holders get trading-fee discounts and other benefits on Binance, the world’s largest spot crypto exchange, essentially serving as a loyalty program for customers.

Retaining users may never be more important than now for Binance as crypto-trading platforms face increased scrutiny by regulators from China to the U.S. Binance in particular, has been clouded recently in controversy. Registered in Malta, which in viewed as having lighter oversight than many other jurisdictions, the company was seen by some critics as not being entirely forthcoming after saying it has no “fixed offices in Shanghai or China” following a report that police raided facilities in the nation’s biggest city. That said, demand seems to be unabated.

“Binance is out-executing the rest of the market, period,” said Kyle Samani, co-founder of Austin, Texas-based Multicoin Capital Management LLC, which holds BNB coins.

Binance has grown its market share from about 30% of volume from top- ranked exchanges to 45%, according to researcher CryptoCompare, which ranks exchanges. Even though it only launched futures in September, the private firm is already the fourth-largest Bitcoin futures exchange, according to tracker Skew.com.

One factor behind the surge is Binance’s practice of destroying — or ’burning’ — BNBs, to reduce the amount of coins outstanding. Every quarter Binance burns BNBs based on its trading volume during that three-month period. The exchange likely booked its most profitable quarter ever in the third quarter, even as many cryptocurrencies including Bitcoin tanked, according to estimates published by Multicoin Capital.

To spur growth, Chief Executive Officer Changpeng Zhao has been on an acquisition spree, most recently buying DappReview, which helps developers promote and track performance of applications. On Nov. 20, it snapped up India’s WazirX, letting locals buy and sell cryptocurrencies with fiat.

While BNB surged in the first half of the year, returns have mirrored the majority of the cryptocurrency world since as prices eased. For Binance, one reason may be the decline of so-called Initial Exchange Offerings where customers used BNB tokens to purchase coins sold by startups on the Binance exchange.

“BNB’s large relative outperformance came in the first part of this year, as the IEO craze reached its peak,” said Travis Kling, who runs crypto hedge fund Ikigai Asset Management in Los Angeles, and wouldn’t say what his position in BNB is. “IEOs have cooled off a lot over the last six months, and BNB has given back a lot of its relative outperformance.”

Competition is also getting tougher. Many exchanges have begun issuing tokens offering trading-fee discounts as well.

“The exchange business is getting incredibly crowded,” said Jeff Dorman, chief investment officer at Los Angeles-based investment firm Arca Funds. “At the start of 2019, BNB was the only exchange token available. Now there is BNB, OKB, KCS, HT, FTT, FLEX and LEO. That’s a lot of competition for the same customers.”

Author: Olga Kharif

Read more at: https://www.bloomberg.com/news/articles/2019-12-06/best-performing-cryptocurrency-isn-t-what-you-would-expect