The amount of money that initial coin offerings attracted in this year’s third quarter fell significantly compared to the second quarter.

According to a report by crypto market analysis firm ICORating, the amount that was raised via ICOs from July to September reduced by 48 percent compared to what was raised from April to June this year.

During Q3, more than half of the ICO projects that were announced only managed to raise up to US$100,000 while only a tiny number got listed on crypto exchanges. Of the 597 projects which were staged in the third quarter, only 24 got listed on exchanges.

“57 percent of ICO projects announced in Q3 2018 were not able to raise more than 100,000 USD. Only 4 percent of all announced ICOs were listed on exchanges,” said ICORating.

‘Only an Idea’

The report also noted that more than three-quarters (approximately 76.15 percent) of the startups that were raising money were only armed with an idea rather than a functional product. This was an increase of 18.72 percent from the second quarter. Unsurprisingly, this category of projects constituted the highest percentage of fundraising initiatives that were unsuccessful, with 72 percent of such projects at the idea stage failing to raise more than US$0.5 million.

On the other hand, approximately 10.22 percent of the projects had a minimum viable product (MVP). Meanwhile, 5.79 percent, 4.77 percent and 1.7 percent of the projects were in the beta, alpha, and code phases respectively. Only 1.37 percent of the projects had a release-stage product.

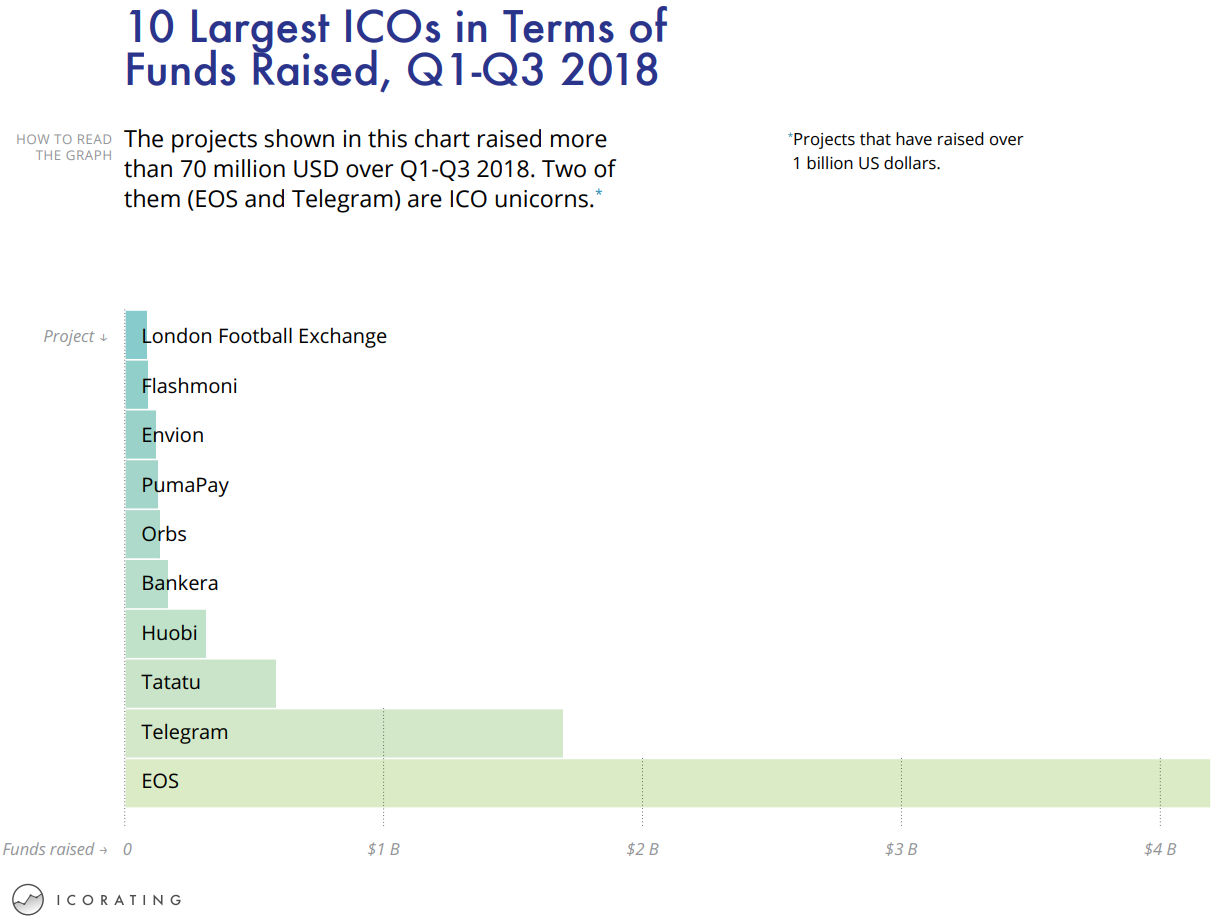

Unlike in Q1 and Q2 when two ICO unicorns – EOS and Telegram — raised more than US$1 billion, in Q3 the highest amount that was raised by an individual project was slightly over US$70 million in the case of the London Football Exchange project. This was also the only project that managed to feature in the top 10 fundraiser list for the three quarters of this year.

Disappointing Quarter

There was also little to cheer about during the quarter for investors. With 597 projects reviewed, the median return from tokens was -22 percent with 79 percent of the tokens trading below their ICO price. According to ICORating, there were multiple reasons for the disappointing quarter.

“The market in Q3 shows signs of overall disappointment in traditional ICOs as a means of venture financing,” the crypto markets analysis company wrote. “This has multiple reasons behind it — a significant drop in returns for ICO participants, an increasing lack of transparency from ICO teams/projects, an overall market downtrend, the fact that investors became more experienced and prudent in their decisions, regulation activities, a lack of new ideas from project teams and not-so-fast pace of actual blockchain implementation in the traditional market.”

Featured Image from Shutterstock

Follow us on Telegram or subscribe to our newsletter here.